Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

How to Transfer from Crypto Wallet to Fiat Wallet? Transferring funds from a crypto wallet to a fiat wallet has become a pivotal part of modern personal finance and business operations, especially in 2025 as cryptocurrency reaches mainstream adoption. Whether you’re a beginner looking to cash out your first Bitcoin, a seasoned trader seeking liquidity, or a business settling cross-border payments, understanding this process is crucial.

With global crypto users projected to surpass 800 million by 2025 (Statista, 2024), more people face the need to convert digital assets into spendable cash for daily life, bill payments, or emergency funds. Increasing regulatory oversight, new compliance rules, and a surge in scams and phishing risks mean that safe and efficient off-ramping is more important than ever.

As crypto trends in 2025 point toward stricter KYC (Know Your Customer) requirements, evolving AML (Anti-Money Laundering) standards, and wider integration with mainstream payment platforms, understanding the transfer process from crypto to fiat is more relevant than ever. This guide will help you navigate the process, avoid common pitfalls, and choose the best approach, whether you’re an individual or representing a business.

Below are Key Concepts & Definitions for Crypto-to-Fiat Transfers:

Safe and efficient crypto-to-fiat transfers are essential for onboarding new users, supporting daily spending, and integrating crypto with traditional finance. Leading platforms like Coinbase and Cash App have simplified this, but each step requires clarity to prevent mistakes.

To explore similar concepts, check our crypto knowledge section for beginner-friendly explanations.

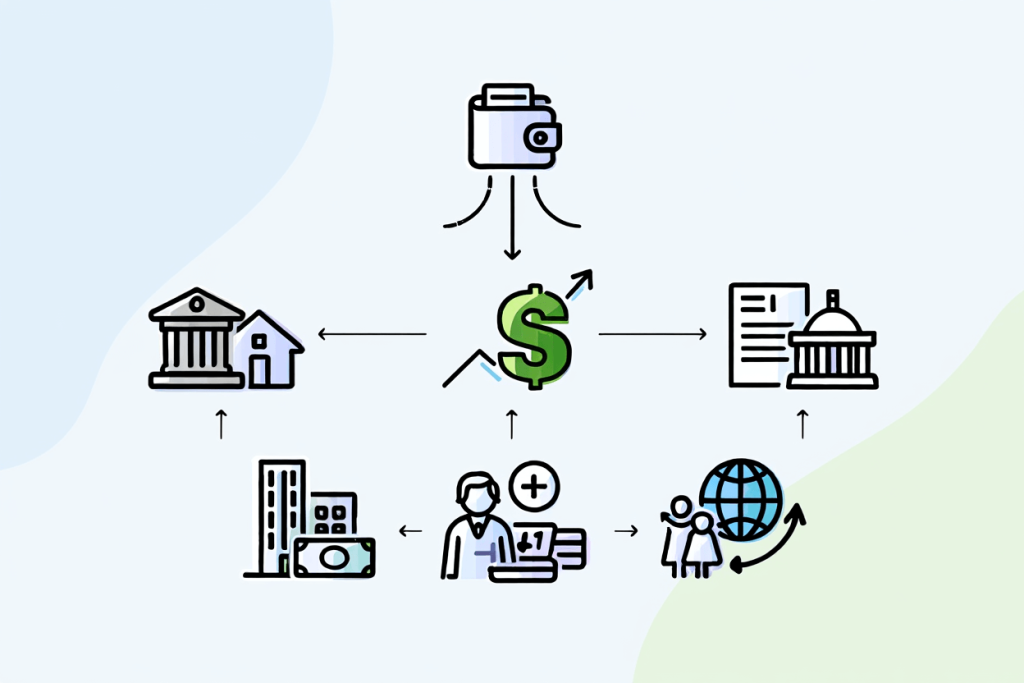

People transfer from crypto wallets to fiat wallets for various reasons, reflecting the broader integration of digital assets into everyday life. Here are the top use cases:

In 2025, the profiles extend from retail investors to large enterprises and remittance users, underlining the need for fast, secure, and reliable transfer methods. According to Chainalysis (2024), up to 40% of surveyed crypto holders off-ramped their assets at least once in the past year, underlining the growing practicality and necessity of crypto-to-fiat flows.

There are several main ways to convert crypto to fiat. Here’s a comparative overview to help you decide which is best for your needs in 2025:

| Method | Platforms/Examples | Speed | Fees | Ease of Use | Security | Best For |

|---|---|---|---|---|---|---|

| Centralized Exchanges | Coinbase, Binance, Kraken | 1–3 days (bank withdrawal) | Low-Medium | Easy | High (if reputable) | Most users |

| Peer-to-Peer Platforms | Binance P2P, LocalBitcoins | Minutes–few hrs | Variable | Moderate (depends on counterparty) | Medium (relies on platform escrow) | Fast local cash outs |

| Crypto ATMs | Bitcoin ATM networks | Instant–hours | High | Easy | Low-Medium | Physical cash |

| Payment Apps | PayPal, Revolut, Cash App | Instant–1 day | Low-Medium | Very Easy | High | Everyday use |

| OTC Desks | Genesis Global, Cumberland | Hours–1 day | Negotiable | Difficult (high min. amounts) | Very High | High net-worth, institutions |

Centralized Exchanges offer the widest selection of supported currencies and generally provide the best security, but processing times depend on your banking method. P2P Platforms are popular in emerging markets for instant cash or local payments but require vetting counterparties. Crypto ATMs are fast but can carry hefty service fees. Payment Apps are seamless for small-to-mid transfers, integrating with many banks. OTC Desks are for large, institutional volumes and can offer personalized terms.

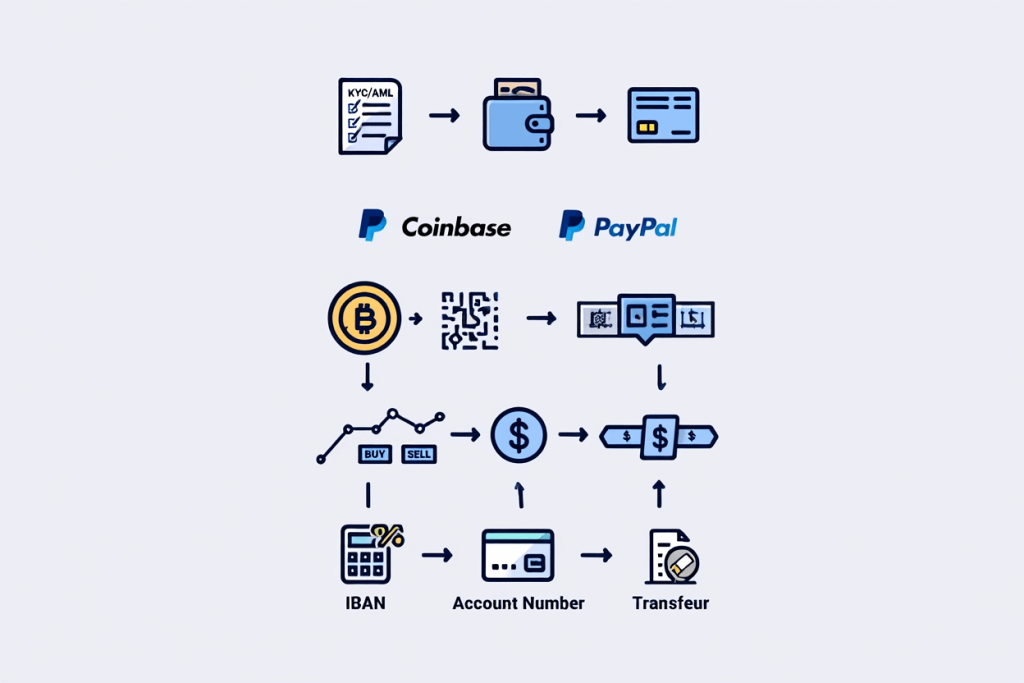

Below are how to Transfer from Crypto Wallet to Fiat Wallet:

Preparation ensures smoother, quicker transfers and higher acceptance rates whether you’re off-ramping $50 or $50,000.

Patience is key here, and always use copy-paste to avoid typos. If in doubt, send a small test amount first.

Once your crypto arrives, you’re ready to sell:

For optimal exchange rates, check current market prices and fee schedules. On platforms like Binance, UI guides you step by step through the selling process.

Allow processing time; bank transfers may take 1–3 business days depending on country and method.

Understanding the costs and timing helps you avoid surprises:

| Platform | Network Fee | Platform Fee | Withdrawal Fee | Typical Processing Time | Limits |

|---|---|---|---|---|---|

| Coinbase | $2–5 (ETH/BTC) | 0.5–2% | $0–5 | 1–2 days | $2K–$50K/day |

| Binance | $1–4 | 0.1–0.6% | $1–$10 | 1–3 days | $2K–$100K/day |

| Paypal | Flat $1–2 | 0.4–1.5% | $0–5 | Instant–1 day | $5K–$25K/day |

| Crypto ATM | Included | 5–15% | Included | Instant | $500–$10K/txn |

| Revolut | $1–3 | 0.5–2.5% | $1–3 | 1–2 days | $2K–$20K/day |

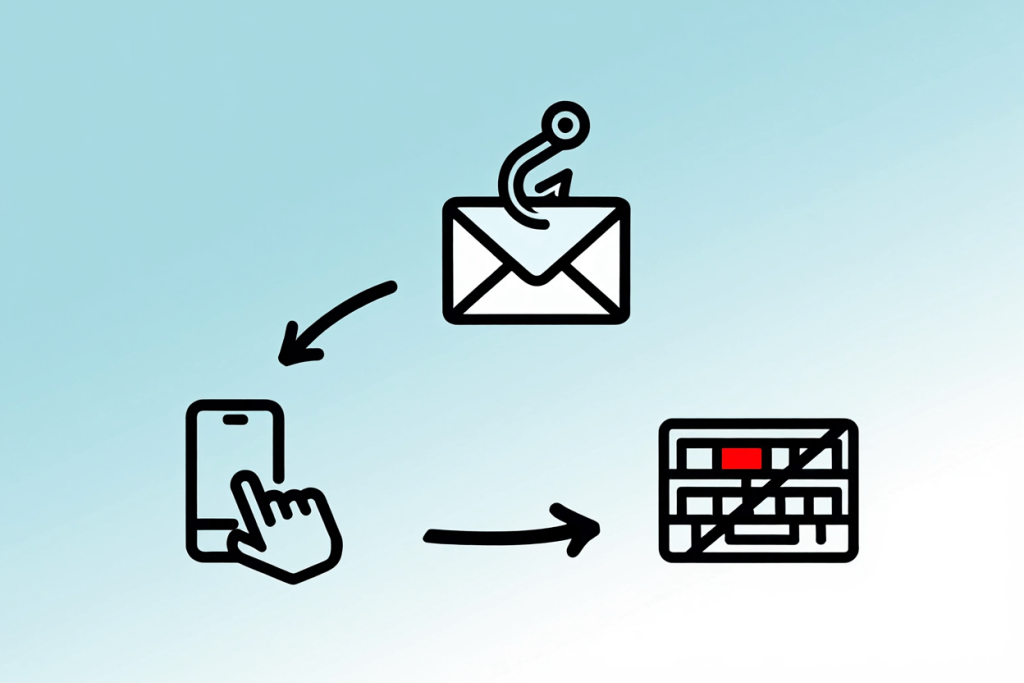

Prevention Tips: Always verify URLs, enable 2FA (two-factor authentication), use strong, unique passwords, and never share login credentials. Research platforms, for example, check official domain links via CoinMarketCap or app stores. Use small test transfers when moving large amounts.

If something goes wrong (e.g., delay or failed transfer), contact platform support with transaction details and screenshots. Funds lost due to wrong addresses are typically unrecoverable; platforms rarely reverse such transactions. Always check for official scam warnings from financial authorities or your chosen platform’s notice section for the latest threats.

KYC and AML checks are required by law. Platforms collect names, SSNs, proof of address, and sometimes selfies. The IRS treats crypto-to-fiat transactions as taxable events, capital gains must be reported using Form 8949 and Schedule D. Keep records of every off-ramp transaction, including date, amount, and purpose.

GDPR and MiCA rules require verified identities for all significant crypto-to-fiat flows. Most countries ask users to self-report trades and taxable gains. Check your nation’s financial authority for up-to-date guidance.

Expect strong identity requirements; regulations vary by jurisdiction. In India, for example, every withdrawal triggers a TDS (tax deducted at source). Japan mandates reporting for all high-volume transactions.

Brazil and South Africa are tightening AML controls while Russia and China impose restrictions on direct exchange. Review local banking and crypto policy for permissible platforms and withdrawal methods.

View more:

| Method | Speed | Fees | Ease | Security | Best For |

|---|---|---|---|---|---|

| Exchange | Slow–Medium | Low | Easy | High | General Users |

| P2P | Fast | Varies | Moderate | Medium | Cash/Local |

| ATM | Very Fast | High | Very Easy | Low | Quick Cash |

| Payment App | Fast | Low–Medium | Very Easy | High | Everyday Use |

| OTC Desk | Medium | Negotiable | Difficult | Very High | Large Transfers |

This overview lets you quickly compare off-ramp methods by your top priority, whether it’s cost, speed, or security. In general, exchanges and payment apps are the most user-friendly for everyday off-ramping, while OTC and P2P cater to specific needs or locations.

| Term | Definition |

|---|---|

| Spread | Difference between buy and sell price, platform profit margin |

| KYC | Know Your Customer, identity verification process |

| AML | Anti-Money Laundering, regulations to prevent crime |

| Private Key | Secret code required to access your crypto assets |

Navigating crypto-to-fiat transfers in 2025 means balancing efficiency, compliance, and security. By understanding your options, exchanges, P2P, ATMs, payment apps, and OTC, you can choose what fits your needs and risk tolerance. Remember to account for fees, limits, and regulations in your region, and always prioritize safety throughout each step. Equipped with the latest trends, platform comparisons, and practical advice, you’re ready to off-ramp crypto smoothly and cost-effectively, whether as a beginner or a crypto native.

Web Tai Chinh delivers real-time updates and clear insights into the world of finance. Gain fast, reliable guidance and step confidently into your next investment with an understanding of both the basics and the fine print.

📞 Contact: 055 937 9204

✉️ Email: webtaichinh@gmail.com

📍 Address: 13 Ho Tung Mau, An Binh, Di An, Binh Duong