Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

When entering the world of cryptocurrencies in 2025, a common question many ask is: How many crypto wallets should I have? The most practical answer, backed by both expert practice and current crypto trends, is that most users will need 2 to 3 crypto wallets to achieve a balance of security, convenience, and smart asset management. Simply put, a crypto wallet is a digital tool that stores and manages your blockchain assets like Bitcoin or Ethereum.

Its main job? Provide secure access to your coins and tokens, manage multiple assets, and protect your digital wealth from loss or theft. The best number of wallets isn’t one-size-fits-all. It depends on your investment goals, risk profile, daily habits, and asset diversity. For instance, security breaches continue to be a major threat, Chainalysis reported over $1.7 billion in crypto stolen just in 2023, often because users kept everything in a single wallet.

In contrast, dividing holdings can help you recover even if one wallet is compromised. Throughout this guide, you’ll learn why different users (traders, long-term holders, NFT collectors, businesses) require different setups, and how to create a personal strategy that maximizes safety and peace of mind.

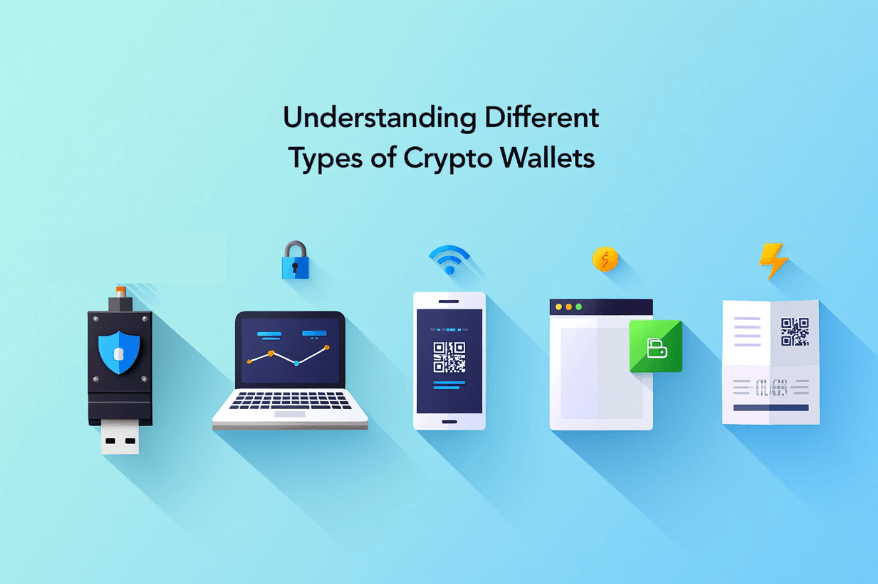

Before deciding how many wallets you need, it’s crucial to understand the main types available. Each wallet type has unique strengths, weaknesses, and best-fit scenarios, especially considering evolving crypto trends in 2025 such as increased biometric security and seamless cross-device synchronization.

| Type | Security | Convenience | Best For | Examples |

|---|---|---|---|---|

| Hardware | Very High | Medium | Long-term, large holdings | Ledger, Trezor, SafePal |

| Software/Desktop | Medium | High | Frequent access, multi-asset management | Exodus, Electrum |

| Mobile | Medium | Very High | Everyday spending, traveling | Trust Wallet, MetaMask, Coinbase Wallet |

| Web | Low to Medium | Very High | Quick access, DeFi/NFT trading | MetaMask (browser extension), Binance Wallet |

| Paper | High if used right | Low | Cold storage, inheritance | BitAddress.org (generator), MyEtherWallet (offline) |

By understanding these types, you’re ready to choose the mix that best fits your personal crypto management strategy.

To explore similar concepts, check our crypto knowledge section for beginner-friendly explanations.

So how do you know your magic number? The ideal number of crypto wallets depends on a handful of key factors, unique to each user and shaped by both risk management and how you interact with the crypto ecosystem.

Are you managing life-changing sums or just experimenting? High-value wallets should live on more secure channels (like hardware), while your spending or experimental funds can stay hot (software or mobile). If your risk tolerance is low, a single well-secured hardware wallet may suffice. But for most, splitting assets offers more peace of mind.

Diversifying assets (holding Bitcoin, Ethereum, various tokens, NFTs, etc.) pushes you toward multiple wallets for organizational clarity and reduced risk. Advanced users and collectors often keep specific wallets for NFTs, staking, or DeFi protocols in line with 2025’s increasingly complex crypto landscape.

If you trade daily, you’ll want separate hot wallets for speed, while long-term investors (hodlers) need ultra-secure storage. NFT/DeFi enthusiasts benefit from dedicated wallets for connecting to smart contracts and decentralized apps, minimizing overall exposure in case of phishing or platform risk.

If you travel, share accounts with family, or need emergency contingencies, having at least one backup wallet in a separate location (or format) can make all the difference. Studies show users with at least two wallets are up to 60% less likely to lose all crypto in a single incident (source: Ledger security survey, 2024).

Using multiple wallets is the digital equivalent of not keeping all your eggs in one basket. If one wallet is compromised, via phishing, malware, or even social engineering, the rest stay safe. Diversifying across hardware, mobile, and web wallets also limits systemic risk, as demonstrated in 2023 when multi-wallet users retained most funds after global exchange hack events.

Separate your long-term investment (core funds) from your daily spending or trading (satellite funds). This is even more relevant in 2025, when fast-paced DeFi, NFT drops, and layer-2 scaling solutions (like Arbitrum and zkSync) encourage active wallet usage.

With hundreds of coins, tokens, and NFTs available, distinct wallets can keep your finances organized and provide clear records for taxes, portfolio tracking, or sharing with advisors. Many experienced investors now maintain separate wallets for stablecoins, yield farming, and governance tokens to avoid cross-risk.

KYC (Know Your Customer) requirements, local regulations, and privacy concerns may warrant further wallet separation. A private wallet can avoid linking your identity to all your crypto, while regulated wallets keep you compliant when converting to fiat or reporting to authorities.

The strategy of layered wallet use continues to offer real-life benefits, helping both prevent disaster and streamline daily crypto management.

For most individuals in 2025, the Core and Satellite model strikes the ideal balance:

| User Profile | Recommended Wallets | Rationale |

|---|---|---|

| Beginner | 1 hardware, 1 mobile | Maximum safety with flexible daily spending |

| Active Trader | 1 hardware, 2 hot (DEX, DeFi) | Separate for trades, security, and dapps |

| NFT/DeFi Enthusiast | 1 hardware, 1 web/mobile each for DeFi/NFTs | Minimize exposure to risky smart contracts |

| Business/Team | 1 multi-signature, 1 team hot, backups | Shared access, audit trails, legacy planning |

By following these models and considering your unique needs, you move from reactive wallet usage to a robust, resilient crypto storage architecture.

Below are best practices for Managing and Tracking multiple Crypto Wallets:

Recent stories, like a 2024 user who recovered lost NFTs thanks to meticulous tracking and labeling, underline how implementing these habits now saves headaches (and assets) later.

Case studies from industry audits show that layered, redundant security strategies have saved users from full wipeouts during phishing attacks and platform failures.

Below are Real-Life scenarios:

Emily, a first-time investor, wants to hold a small Bitcoin and Ethereum amount. She buys a Ledger Nano (hardware) for long-term savings and installs Trust Wallet (mobile) for occasional payments. Two wallets, clearly named and safely backed up, cover her needs simply and securely.

Ali trades daily on decentralized exchanges. He keeps a large store of ETH on hardware, plus two separate MetaMask accounts, one for trading, one for connecting to new DeFi projects. Regular audits and clear wallet names help him stay organized and agile.

CoffeeCo, a business accepting crypto payments, uses a Gnosis Safe (multi-signature, requiring 2 of 3 executives to co-sign), an operations wallet for day-to-day business, and a cold storage vault for reserves, plus detailed written recovery plans for business continuity.

No strict limits. Technically, you can create unlimited wallets, but more isn’t always better. For most, fewer than five is manageable. Too many causes confusion and security gaps.

A reputable hardware wallet (Ledger, Trezor, SafePal) is considered the safest for long-term holding. For active traders, a combination of hardware (for savings) and a hot wallet (for activity) is best.

| Mistake | Solution |

|---|---|

| Unlabeled wallets | Use descriptive names with purpose/date |

| Poor backup procedures | Back up recovery data in multiple secure places |

| Forgotten passwords/phrases | Use password managers, consider printed backup copies |

| Neglecting to update wallet software | Schedule routine updates/checks |

Exchanges are convenient for trading but risky for long-term storage. As 2022-2024 collapses (FTX, Hotbit) revealed, you don’t control the keys, and bankruptcy or hacks can freeze your funds. Always move significant assets off-platform to wallets you control.

| Brand | Type | Pros | Cons |

|---|---|---|---|

| Ledger | Hardware | Reliable, global support, 2025 Bluetooth & biometric | Requires physical device |

| MetaMask | Web/Mobile | DeFi/NFT support, easy dapp access | Susceptible to phishing/extension attacks |

| Gnosis Safe | Multi-sig | Team security, flexible role control, great for businesses | Learning curve, slower transactions |

Community Forums and Official Guides to Crypto Wallet Management

These resources provide practical help, peer support, and up-to-date guidance as regulations and wallet technology evolve.

Determining how many crypto wallets you should have in 2025 is a personal decision shaped by your investment size, activity level, and security needs. For most, 2-3 well-managed wallets, balancing cold storage and daily access, offer an ideal mix of safety and flexibility. By understanding wallet types, building a layered security approach, and adopting smart organization practices, you’ll safeguard your digital assets against evolving crypto threats. No matter your experience, revisit your setup as your portfolio or crypto trends change, and continue learning from trusted community hubs.

Web Tai Chinh is a portal that updates news and information related to finance quickly and accurately, helping users have an overview before investing, clearly understanding concepts and terms related to Finance.

📞 Contact: 055 937 9204

✉️ Email: webtaichinh@gmail.com

📍 Address: 13 Ho Tung Mau, An Binh, Di An, Binh Duong