Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

In 2025, crypto holders still ask a vital question: does my crypto still grow in a wallet, or does it just sit idle? The short answer is no, your crypto balance doesn’t automatically increase by sitting in a wallet, but its value can rise or fall with the broader market.

This guide clears up common misunderstandings, looking at how wallets function, why market movement matters, the types of wallets available, and what you can actually do to make your crypto grow. Whether you’re new or seasoned in digital assets, this article walks you through wallet basics, passive income strategies, legal factors, and security best practices, ensuring your crypto journey is both informed and secure.

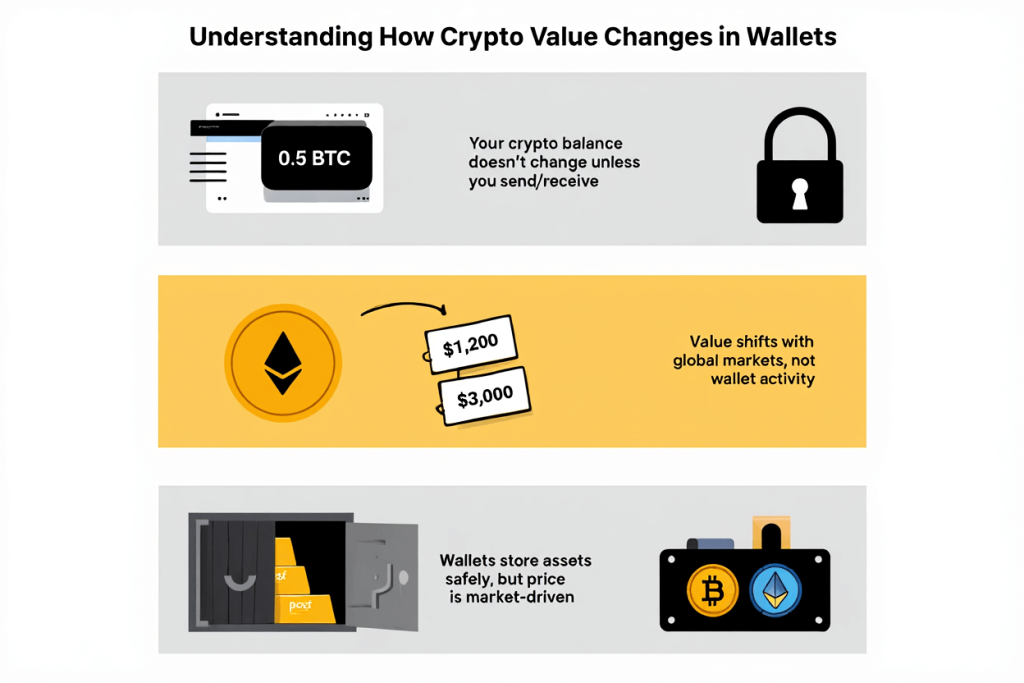

Below show how crypto value changes in wallets:

When you move cryptocurrency to a wallet, whether that’s a mobile app, hardware device, or browser-based tool, the core function is safekeeping. Your crypto balance (the number of coins or tokens) remains unchanged as long as you don’t send or receive additional funds. For example, if you deposit 0.5 Bitcoin into your wallet, that number stays the same until you act. Wallets simply secure your private keys and allow you to prove ownership of those assets on the blockchain.

The key distinction is between how much crypto you own (quantity) and how much it’s worth (value). While the wallet keeps your token count steady, the real-world value of those tokens can swing dramatically because digital assets are priced in global markets. For example, 1 ETH was worth about $1,200 in mid-2022, but in parts of 2023, its value surged over $3,000. If you held that ETH in a wallet, the quantity didn’t change, but the asset’s value did.

Think of storing gold bars in a vault. The vault doesn’t magically mint new gold, but the price per ounce can fluctuate based on supply and demand. Crypto wallets work the same way: they act as safes for your assets, with the actual value determined by crypto market trends, news (like Ethereum upgrades or Bitcoin halvings), and wider adoption shifts.

Data from sources like CoinMarketCap or Messari illustrate these price changes with daily, monthly, or yearly charts showing the volatility in value while the coin count remains stable.

Crypto wallets fall into two broad categories: hot wallets (internet-connected, such as mobile or web wallets) and cold wallets (offline, like hardware wallets or paper wallets). Hot wallets are convenient for frequent transactions but are more exposed to hacking risks. Cold wallets, disconnected from the internet, offer stronger protection against cyber threats and are favored for long-term storage.

Another crucial distinction is between custodial wallets (where a third party, often an exchange, controls your private keys) and non-custodial wallets (where only you control your keys). Non-custodial wallets, such as MetaMask, Trezor, or Ledger, provide greater user control and security, if managed properly. Custodial wallets offer convenience but can present risks if the provider is compromised.

No wallet will grow your crypto balance just by storing coins. However, some wallets offer features like staking integration or decentralized app (dApp) support, enabling passive income. Here’s a comparison table:

| Wallet Type | Security | User Control | Staking/Passive Support |

|---|---|---|---|

| Hot (e.g., Trust Wallet) | Lower | High (Non-custodial) | Yes (some) |

| Cold (e.g., Ledger Nano X) | Highest | Highest | Yes (via apps) |

| Custodial (e.g., Coinbase) | Medium | Low | Yes, but provider controls keys |

The wallet type you choose impacts how safely your value is protected, but not its intrinsic growth.

Explore more concepts like this on our crypto section.

Picture this: you hold 1 ETH in a secure wallet. In January, it’s worth $2,000. By June, if ETH’s price rises to $2,400, your 1 ETH is now worth $2,400. You’ve gained dollar value, but your coin quantity hasn’t changed. News, regulations, technology advances (like Ethereum Layer 2 upgrades), and even global macroeconomics can cause crypto prices to rise or fall, directly affecting your portfolio’s value in your wallet, but not the number of coins.

Related articles that might attract you:

Below are ways to actually grow your crypto:

Staking allows users to earn crypto rewards by locking their coins in support of proof-of-stake blockchains (like Ethereum, Solana, or Cardano). By staking coins, you’re helping validate transactions and secure the network. Many wallets and exchanges offer built-in staking features, letting you earn annual yields (APY) ranging from 3% to 15%, depending on the token. For example, staking ADA through Yoroi Wallet or Ledger can offer 5-6% APY, while Ethereum staking APYs vary with network conditions.

Crypto lending lets you loan your assets via platforms like Aave or Compound, earning interest (often in the 3-10% APY range). This can be done through DeFi wallets with lending integration, or via centralized platforms (though the latter may expose you to custodial risks and regulatory uncertainties).

| Pros | Cons |

|---|---|

| Earn passive income; flexible terms | Lending platforms can be hacked or go bankrupt; borrower default risk |

Yield farming involves providing liquidity to DeFi protocols (like Uniswap or PancakeSwap) and earning variable rewards, sometimes exceeding 20% APY, but often with high risk and complexity. Liquidity mining rewards users who deposit tokens into pools, often receiving platform-specific tokens in return. It’s important to understand these strategies are best for advanced users comfortable with impermanent loss and smart contract risks.

For many, the best starting point is staking through a reputable wallet or exchange, ideally after thorough research on platform history and security.

Crypto hacks were estimated by Chainalysis to have cost users and exchanges over $2 billion in direct losses in 2023 alone. Major threats include phishing scams, malware, SIM swaps, and physical loss of seed phrases. If your wallet is compromised or you lose access to your private keys, your assets are irretrievable, regardless of how much they’ve appreciated.

Maintain multiple physical backups of your seed phrase in secure, separate locations. Providers like Ledger and SafePal offer recovery tips and encrypted storage solutions. Familiarize yourself with your wallet’s recovery process before disaster strikes, waiting may cost you everything. Also, periodically check manufacturer support for wallet updates and security patches.

Below are tax and legal implications that you need to know:

Generally, transferring crypto between wallets you control does not trigger a taxable event. However, moving coins between personal and third-party wallets may require documentation for tax authorities, especially in stricter jurisdictions.

Tax laws vary considerably worldwide. In the US, the IRS treats staking rewards and interest from lending as taxable income. The UK’s HMRC and EU countries generally require capital gains reporting upon sale or disposal. Asian markets like Singapore and Japan are evolving their frameworks, with some more lenient on long-term holding gains. Always consult the latest local guidance and, if needed, a tax professional.

Unlike banks, most standard wallets do not pay interest simply for storing your assets. Earning interest requires you to opt into staking, lending, or DeFi services, and these come with their own risks and requirements.

Promises of guaranteed profits from high-interest wallets or invitations to join secret passive income clubs are often classic warning signs. Regulatory agencies like the FCA and SEC have published numerous consumer warnings about crypto Ponzi schemes and high-yield scams. Always research before depositing into any wallet promising returns.

A common misconception is that HODLing (holding crypto) in a wallet always leads to profit. While long-term holding can pay off in bull cycles, there is no inherent or automatic growth mechanism, active earning strategies are required for real yield.

Below are how to choose the right wallet for your crypto goals:

Some wallets, like MetaMask (for EVM chains) or Trust Wallet, allow interaction with multiple blockchains and decentralized apps. Hardware wallets (Ledger, Trezor) can store dozens of different tokens with layered security protections. Choosing wallets with staking, lending, and DeFi dApp access can better suit users looking to diversify or maximize opportunities.

Top choices for 2025 might include:

Advanced wallet technologies are arriving fast. Multi-Party Computation (MPC) wallets split private keys for extra security. Multi-chain and Layer 2 support is rapidly becoming standard, letting users manage assets across Ethereum, Solana, Polygon, and more within a single interface. Private key innovations like social recovery and biometric access are reducing risks of irretrievable losses.

Regulatory attention is intensifying globally. Expect 2025 to see tighter compliance requirements, mandatory reporting for certain wallet types, and continued moves toward KYC for custodial services. This push for oversight will likely affect which wallets and features are available in different regions.

Wallets are evolving into crypto super apps, not just for holding, but as portals to Web3, NFTs, and DeFi dApps. According to recent forecasts, the crypto wallet market is on track for double-digit CAGR growth through 2028, driven by increased NFT adoption and the expansion of decentralized finance. Wallet providers like MetaMask and SafePal are integrating swaps, staking, and even in-app NFT galleries, blurring lines between storage and interactive finance hubs.

No, storing crypto alone does not generate interest. Passive earning requires using staking, lending, or specific DeFi protocols.

A wallet securely stores your private keys and assets, think of it as your personal vault. An exchange is a marketplace for buying, selling, and sometimes holding crypto; they often provide custodial wallets, but you don’t hold the private keys.

| Wallet | Staking | Lending |

|---|---|---|

| Trust Wallet | Yes | No |

| Ledger Live | Yes | Limited |

| MetaMask | Via dApps | Via dApps |

| Coinbase Wallet | Yes (limited) | Yes |

Self-managed wallets may provide direct access to blockchain staking, sometimes yielding higher APYs due to lower fees. Centralized exchanges often offer convenience but may take a cut. For example, staking ETH on Ledger may offer slightly higher rewards than using Coinbase, but with greater responsibility on the user for security.

To wrap up, your crypto balance doesn’t grow on its own just by sitting in a wallet, the only thing that changes automatically is the market value of your holdings. Real growth comes from actively engaging in strategies like staking and lending, not simply holding. Making the right wallet choice requires balancing security, usability, and earning features, all while staying vigilant against scams and staying compliant with regulations.

As crypto wallets become hubs for DeFi, NFTs, and Web3, understanding their evolving features and limitations is more important than ever. Stay informed, protect your assets, and always research before taking the next step in your crypto journey.

Web Tai Chinh provides up-to-date financial news and comprehensive information, empowering users to gain clarity and insight before investing. We demystify finance concepts and keep you informed on the latest market terms and trends.

📞 Contact: 055 937 9204

✉️ Email: webtaichinhvnvn@gmail.com

📍 Address: 13 Ho Tung Mau, An Binh, Di An, Binh Duong