Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

In the rapidly evolving world of digital assets, the term “FDV” – Fully Diluted Valuation – stands out as a crucial metric in crypto investing and project assessment. FDV measures what a cryptocurrency’s market value would be if every possible token were in circulation at the current price. For both newcomers and experienced investors, grasping FDV is essential for analyzing risks, gauging project potential, and making informed decisions. This guide breaks down the concept of FDV, clarifies its math, highlights its significance and pitfalls, and connects it to related crypto terms.

At WebTaiChinh, our mission is to demystify financial jargon to empower every reader to make smarter investment choices. Misunderstanding FDV can easily lead to misjudging a project’s worth much like mistaking the total potential value of a startup for its actual present-day strength. Before diving deeper, a clear grasp of FDV’s basics provides a sturdy foundation for exploring crypto’s more nuanced measures.

FDV, or Fully Diluted Valuation, represents the hypothetical total value of a crypto project if all its tokens locked, vested, or yet to be created were currently available and trading at today’s market price. Think of it as the equivalent of a public company calculating its value if every authorized share (even those not yet issued or reserved for staff) was already in the market. The concept borrows directly from traditional finance, where “fully diluted market cap” signals what a company could be worth after all shares, options, and warrants have been exercised.

In crypto, FDV bridges legacy financial valuation with the token economy, helping investors forecast what a project might look like at full supply. For example, if Project X currently has only 20% of its tokens circulating but advertises its FDV, it’s projecting what its full value could be often creating confusion if investors mistake that figure for present reality. Common use cases for FDV include project comparisons, fundraising negotiations, and risk assessment, but it should always be viewed in context of circulating supply and unlock schedules. Understanding this difference will help you avoid overestimating a project’s current strength as we move into FDV’s exact calculations next.

The formula for FDV is straightforward:

FDV = Current Token Price × Maximum Token Supply

Step-by-step FDV Calculation:

Example: If “CryptoDemo” trades at $2 and the max supply is 10,000,000 tokens, FDV = $2 × 10,000,000 = $20 million.

| Current Price | Max Supply | FDV |

|---|---|---|

| $2 | 10,000,000 | $20,000,000 |

Sourcing FDV is easy: Most major platforms like CoinGecko and CoinMarketCap list it alongside market cap. This clarity in calculation paves the way to compare FDV with the better-known market capitalization.

See more related articles:

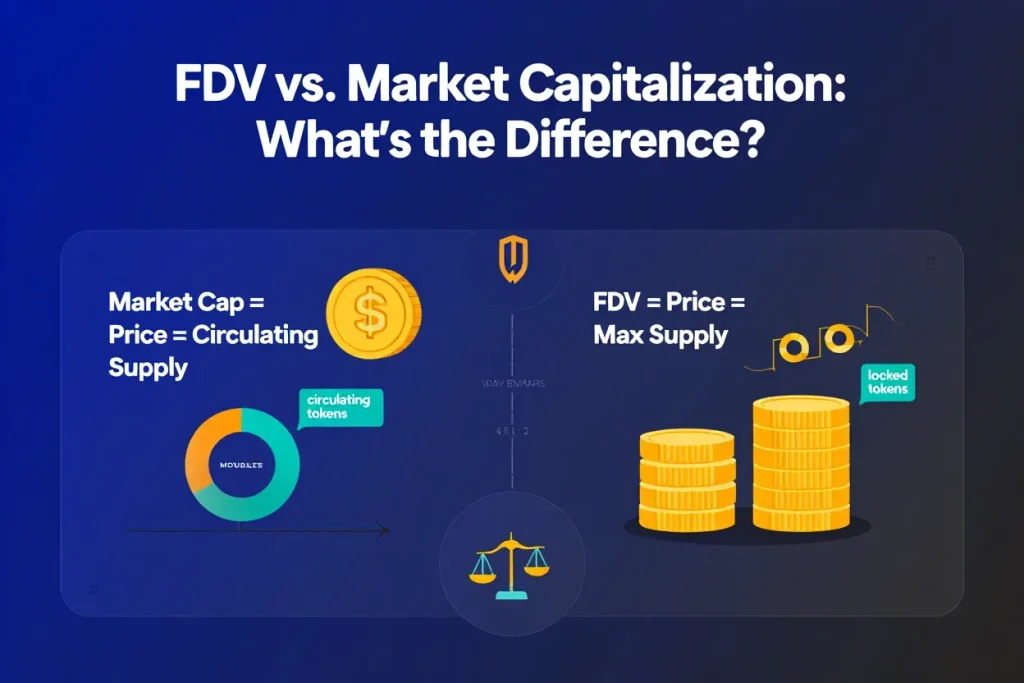

Market capitalization (market cap) is a staple in both traditional finance and the crypto world. It calculates a project’s value based only on tokens actively circulating, using the formula: Market Cap = Current Token Price × Circulating Supply. FDV, on the other hand, considers the project’s hypothetical value if every token was already released, using max supply rather than just circulating supply.

| Metric | Definition | Formula |

|---|---|---|

| Market Cap | Value of circulating tokens | Price × Circulating Supply |

| FDV | Value if all tokens were issued (max supply) | Price × Max Supply |

The difference matters because FDV can sometimes paint an overly optimistic picture, especially when only a fraction of tokens are available for trading. For instance, a project with a low market cap but high FDV may look “cheap” but actually hides incoming token releases that could trigger price drops. In practice, projects especially new launches may promote a high FDV to attract attention or justify valuations, but investors need to scrutinize the circulating supply closely. As visualized in popular infographics, understanding both numbers side-by-side is key for proper token analysis and avoiding surprises as locked tokens unlock in the future.

FDV is an essential metric for anyone analyzing a crypto project’s sustainability and tokenomics. For investors, FDV provides a lens to anticipate future supply changes and dilution, aiding in risk assessment and valuation compared to sector peers. For project teams, it’s a figure often cited during fundraising, token launches, and marketing efforts. Here’s why FDV matters:

Both investors and teams use FDV in capital raising and for projecting a project’s potential market size. As seen with several 2024 token launches, investors who ignored FDV often faced steep losses when large token unlocks hit the market, diluting their holdings sharply. This makes a clear understanding of FDV central to responsible investing and healthy project building, setting the stage for a careful view of its risks.

In 2024-2025, examples like certain Ethereum Layer 2 tokens or high-profile NFT projects have seen massive paper FDVs, but real value lagged far behind once previously locked tokens entered the market. Savvy investors now treat FDV as one of several tools in comprehensive research highlighting the need for contextual analysis alongside other data points.

Related reads to deepen your knowledge:

Sample questions: Is the current supply only a small fraction of the max? Are large unlocks imminent? Is trading volume healthy relative to FDV? Research tools and whitepapers provide deeper data, while reputable analytics sites (like Token Unlocks, Nansen) can help investors stay ahead. This practical checklist ensures FDV is used with context not in a vacuum.

Solid understanding of FDV equips crypto investors to spot risks, compare projects objectively, and avoid hype-driven mistakes in volatile markets. By viewing FDV in tandem with market cap, supply schedules, and project activity, investors enhance their risk management and due diligence skills. Remember: FDV is a powerful metric when handled carefully and combined with thorough research, helping you make smarter, safer choices amid crypto’s fast-changing landscape.

Fully Diluted Valuation (FDV) is a central concept in modern crypto investing, offering insights into a project’s potential value and future dilution risks. By learning how FDV differs from market cap, understanding its calculation, and recognizing its limitations, investors can enhance their evaluation process and protect themselves from common pitfalls. While FDV isn’t flawless, using it thoughtfully as part of a broader research toolkit supports smarter, more confident decisions in 2025 and beyond.

At Webtaichinh, our mission is to provide you with clear, unbiased insights into the world of cryptocurrency through the Cryptocurrency category, helping you navigate complex topics with confidence, without hype or hidden agendas.

Webtaichinh delivers real-time financial updates, ensuring you stay informed about market trends, policies, and global economic developments. As part of our commitment to excellence, we provide accurate information and in-depth analysis, empowering investors to make swift, confident decisions in a dynamic financial world.

For inquiries or personalized assistance, feel free to contact us:

📞 Phone: 055 937 9204

📧 Email: webtaichinh@gmail.com

💻 Website: https://webtaichinh.vn/

📍 Address: 13 Ho Tung Mau, An Binh, Di An, Binh Duong

At webtaichinh, your financial success is our mission.