Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

How much bitcoin does the US government hold? The US. government, long seen as crypto’s toughest regulator, has unexpectedly become one of the world’s largest Bitcoin holders.

Over more than a decade, it has accumulated a massive trove of digital assets, not by buying them, but by seizing them from cybercriminals, darknet marketplaces, and fraudulent operations.

So, how much bitcoin do they hold? And what does this vast crypto cache mean for the future of Bitcoin policy in America?

Let’s break down the numbers, the sources of these holdings, and the strategic pivot that now treats Bitcoin not just as seized evidence, but as a national reserve asset.

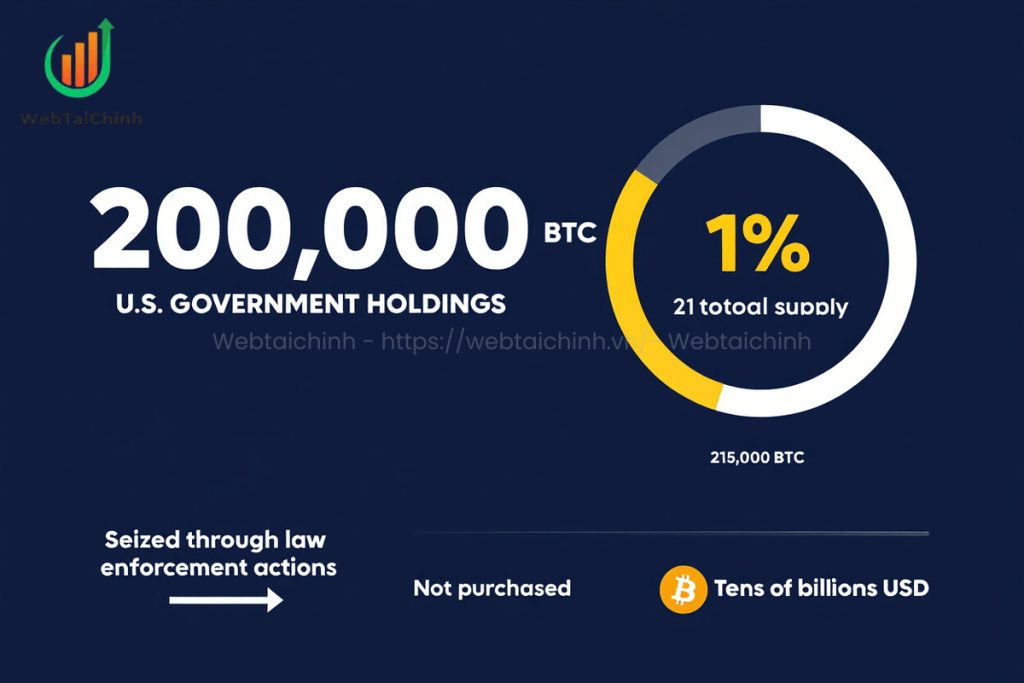

If you’re wondering how much bitcoin does the US government hold, the answer as of mid-2025 is approximately 200,000 BTC, close to 1% of Bitcoin’s capped supply of 21 million coins. This makes it the largest government Bitcoin holder globally. At today’s prices, this stash represents tens of billions of dollars.

Earlier in 2023, estimates were higher, around 215,000 BTC, but the number decreased after a series of public auctions. Still, the government’s current reserves remain formidable.

And no, they didn’t buy it. Almost all of this Bitcoin was seized by US government agencies during law enforcement actions. In other words, the US. government owns Bitcoin that was acquired through seizures, Bitcoin seized by US government authorities.

The US government Bitcoin holdings come primarily from criminal seizures. Over the last decade, multiple high-profile operations brought large amounts of BTC into federal custody.

These are the largest law enforcement actions that brought significant amounts of Bitcoin under US. custody:

These three operations alone account for the majority of Bitcoin seized by US. authorities – forming the foundation for today’s answer to how much bitcoin does the US government hold.

Before the Strategic Reserve era, seized Bitcoin was routinely sold through public auctions.

These early auctions explain why current reserves mostly stem from post-2020 seizures rather than pre-2015 events. Hese early auctions explain why current reserves mostly stem from post-2020 seizures rather than pre-2015 events. As these holdings accumulate over time, many begin to ask how much bitcoin does the US government hold today, and why it matters.

Unlike being forcibly sold due to leverage, like in liquidated in crypto meaning, these government-held Bitcoins were acquired through criminal seizures, not trading errors.

Traditionally, seized Bitcoin was considered forfeited property, to be sold and converted into cash. The US. Marshals Service handled multiple US government Bitcoin auctions between 2014 and 2023.

Knowing how much bitcoin does the US government hold also means understanding how these assets are managed over time. The US. government’s approach to seized Bitcoin has evolved significantly over the years. Once treated strictly as forfeited property, these assets were regularly sold off to generate cash for the Treasury.

Bitcoin across the years

This evolution marks the beginning of a broader strategy, one that treats Bitcoin not merely as evidence, but as a long-term national asset.

In March 2025, a presidential executive order redefined Bitcoin’s role in national policy. Instead of auctioning it all, the government created a Strategic Bitcoin Reserve.

This reserve, similar to the Strategic Petroleum Reserve, consolidates around 200,000 BTC into long-term government custody. The intent? To treat Bitcoin as a strategic digital asset.

The US. government’s pivot to retaining Bitcoin reflects a broader shift toward treating crypto as a financial safeguard. Rather than liquidating seized assets, this strategy emphasizes foresight and resilience.

This repositioning transforms Bitcoin from a seized asset into a pillar of strategic national finance.

Pro Tip: Blockchain analytics firms like Chainalysis now track government wallets, offering transparency into these holdings.

This strategy reflects how institutions treat Bitcoin today — almost like holding reserves in what is a smart wallet crypto instead of converting them to fiat.

The US. government’s Bitcoin strategy could reshape how institutions and investors view crypto, raising questions about the future of Bitcoin government integration.

The US. government’s Bitcoin holdings have a measurable effect on global crypto markets, especially given its control over a significant share of BTC supply.

This direct influence makes the US. a market-moving entity in the crypto ecosystem.

Beyond market effects, government ownership plays a symbolic role in redefining Bitcoin’s reputation within mainstream finance.

Bitcoin gains government legitimacy

In short, official recognition of Bitcoin by the US. helps legitimize its long-term role in the global economy. That’s why understanding how much bitcoin does the US government hold is more than just trivia it reflects Bitcoin’s shift into strategic finance.

Among nations, the US. leads in Bitcoin custody:

|

Country |

BTC Held |

Declared Reserve? |

|

United States |

~200,000 |

Yes |

|

China |

~194,000 |

No |

|

United Kingdom |

~61,000 |

No |

This could inspire a crypto reserve race as more governments recognize the strategic value of Bitcoin and compete to become the largest government Bitcoin holder.

Further reading for curious traders:

No. It acquires Bitcoin mainly through law enforcement seizures.

Yes. Selling or holding affects investor behavior and price.

A federal initiative to hold Bitcoin as a long-term national asset.

In secure government-controlled wallets with strict custody protocols.

To build the Strategic Reserve and avoid undermining Bitcoin’s price.

So, how much bitcoin does the US government hold? Around 200,000 BTC, mostly from cybercrime seizures. What started as evidence is now a financial asset, treated with national significance.

This reserve might shrink through auctions or expand through new seizures. But its existence alone signals that Bitcoin is no longer fringe. It’s part of America’s strategic toolkit.

Web Tai Chinh is a portal that updates news and information related to finance quickly and accurately, helping users have an overview before investing, clearly understanding concepts and terms related to Finance. Explore more insights in our Cryptocurrency category, start your crypto wallet development journey today with the right partner for long-term success.

📞 Contact: 055 937 9204

✉️ Email: webtaichinhvnvn@gmail.com

📍 Address: 13 Ho Tung Mau, An Binh, Di An, Binh Duong