Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

How much Bitcoin has been lost is no longer just a theoretical question it’s a defining factor in understanding Bitcoin’s scarcity and long-term value.

As we step into 2025, experts estimate that nearly 3.9 million BTC are permanently lost, locked away in forgotten wallets, misdirected transactions, or unrecoverable keys. That’s almost 1 out of every 5 Bitcoins gone forever.

For investors, this isn’t just trivia. It changes the math behind Bitcoin’s circulating supply, shifts the dynamics of supply and demand, and strengthens the argument for holding BTC as a scarce digital asset.

Whether you’re a seasoned HODLer or a cautious newcomer, knowing the facts behind lost Bitcoin could reshape how you evaluate your crypto strategy.

Let’s dive deeper with webtaichinh and uncover what the latest numbers and expert insights truly reveal.

To understand how many bitcoins are lost, we first need to identify which behaviors lead to irreversible loss. Bitcoin is often praised for its finite supply of 21 million coins.

But what if that number isn’t quite what it seems? Due to lost keys, forgotten wallets, and unusable addresses, a significant portion of Bitcoin is no longer accessible effectively reducing the real circulating supply.

Let’s examine how much Bitcoin has been lost, according to the latest data in 2025.

Before diving into the causes or implications, it’s crucial to look at the hard data. Leading blockchain analytics firms have spent years analyzing wallet behavior and on-chain patterns to estimate the true number of lost Bitcoins.

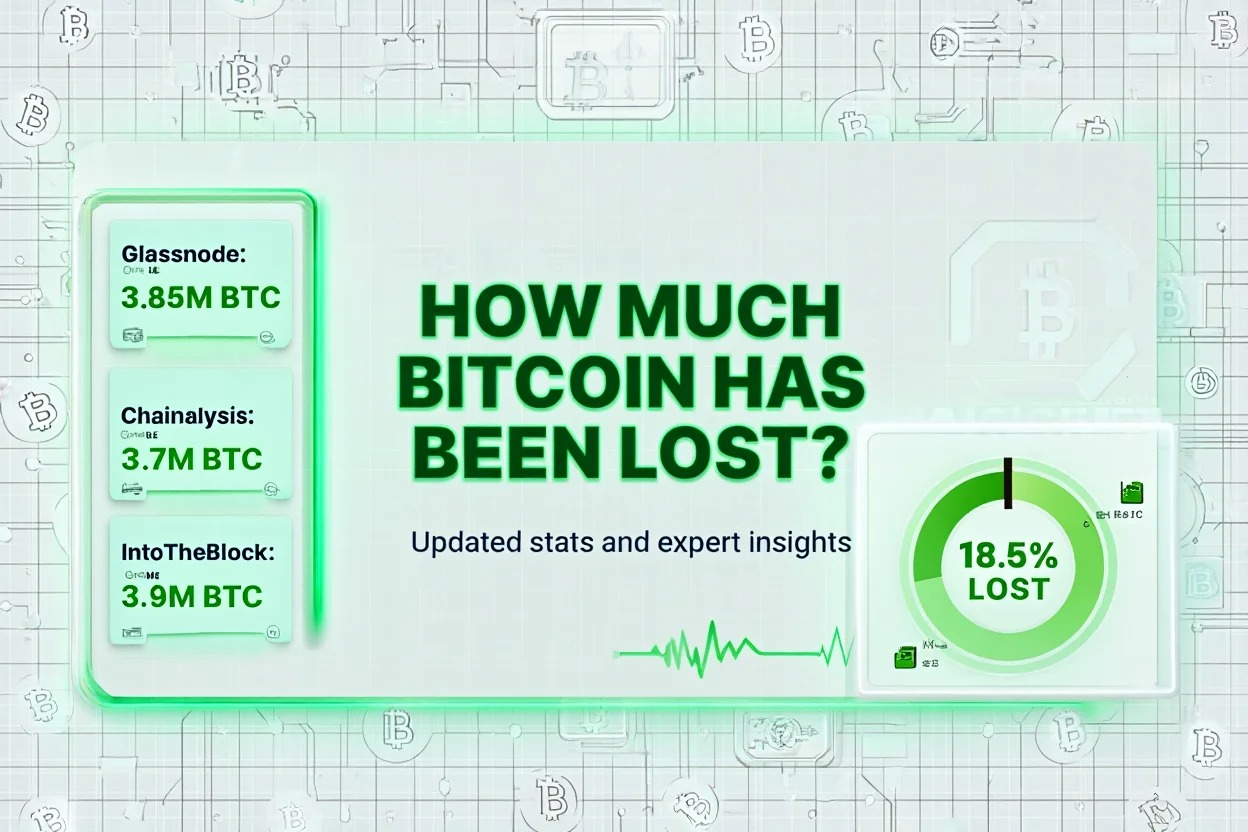

| Source | Estimated BTC Lost | % of Total Supply | Methodology Highlights |

| Glassnode | 3.85 million | ~18.3% | Inactivity >7 years, UTXO age distribution |

| Chainalysis | 3.7 million | ~17.6% | Historic behavior, transaction analysis |

| IntoTheBlock | 3.9 million | ~18.5% | On-chain patterns, smart contract data |

These findings suggest that nearly 1 in every 5 Bitcoins is likely lost forever. This drastically changes the perception of Bitcoin’s scarcity and makes each remaining coin inherently more valuable.

These figures don’t appear out of thin air. But how exactly do experts determine which Bitcoins are truly lost? Analysts estimate how many bitcoin are lost forever by tracking coins untouched for more than 7 years.

Here are the most common approaches:

Take the now-infamous case of James Howells a UK-based early miner who accidentally disposed of a hard drive containing over 8,000 BTC. That’s a real-world example of how digital assets can become permanently unreachable.

In the world of Bitcoin, losing your key means losing your coins forever.

Now that we’ve explored how much Bitcoin has been lost, the next question is: why does it happen at all? Despite Bitcoin being digital and trackable, its ownership depends entirely on access to private keys. Once these are lost, there’s no recovery, no password reset, no help desk.

Let’s explore the most common reasons why millions of Bitcoins have vanished from circulation.

The most common reason for Bitcoin loss is simple human error. People forget, misplace, or never properly store their private keys or recovery phrases.

In the early days of Bitcoin, many users treated BTC as an experiment. Wallets were created on outdated hard drives or written on scraps of paper, with little thought for long-term value.

Real-world example:

James Howells, a Welsh IT worker, accidentally threw away a hard drive in 2013 containing the keys to 8,000+ BTC, now worth hundreds of millions. He’s still trying to get access to his local landfill.

Quick checklist:

Some of Bitcoin’s earliest miners and holders are no longer active; their wallets have remained untouched for over a decade.

Blockchain forensics has identified thousands of addresses with balances ranging from 1 BTC to 10,000 BTC that haven’t moved since the early years. These are often assumed to be:

These coins are technically “available” but practically lost to time.

Not all losses are due to neglect. Some are the result of irreversible mistakes or intentional coin destruction — both of which contribute significantly to how much Bitcoin has been lost over the years.

Bitcoin transactions are permanent. If a user sends coins to a wrong address, even one that no one controls, there is no reversal. Additionally, some users send BTC to so-called burn addresses on purpose to reduce supply or prove commitment.

Common cases:

These actions lead to coins that still exist on-chain but are mathematically unreachable.

View more:

We’ve seen how much Bitcoin has been lost, but what does this mean for the market? Unlike fiat currencies, Bitcoin has a hard cap of 21 million coins.

But if millions are permanently gone, the real supply is much smaller. This loss plays a direct role in shaping Bitcoin’s perceived scarcity, long-term valuation, and investor behavior.

Lost Bitcoins are no longer part of the economy. Even though they exist on the blockchain, they are non-transferable and unspendable. That means they shouldn’t be considered part of Bitcoin’s true supply.

According to data from 2025:

This dramatically reduces the circulating BTC available on exchanges and wallets, especially when combined with:

The result: a more illiquid and constrained market, which can accelerate price movements during high demand.

Economically, Bitcoin behaves like a digital form of gold, limited, mined, and hoarded. When supply drops but demand rises (especially during bull cycles), price tends to increase.

Understanding how much Bitcoin has been lost is crucial for investors, as it directly affects Bitcoin’s scarcity and long-term value proposition.

Here’s why lost coins matter to investors:

Many long-term investors consider lost Bitcoin a feature, not a bug. It supports the scarcity thesis and validates the narrative of Bitcoin as a resilient store of value.

Several institutional reports from Fidelity and NYDIG have even referenced lost BTC as a reason to allocate capital to Bitcoin for the long haul.

After learning how much Bitcoin has been lost and how easily it can happen, a natural question arises: is there any way to get them back? Unfortunately, due to Bitcoin’s decentralized and permissionless nature, most losses are irreversible.

The very feature that makes Bitcoin censorship-resistant also makes recovery extremely difficult. Still, there are rare exceptions and edge cases worth exploring.

Can lost Bitcoins ever be recovered

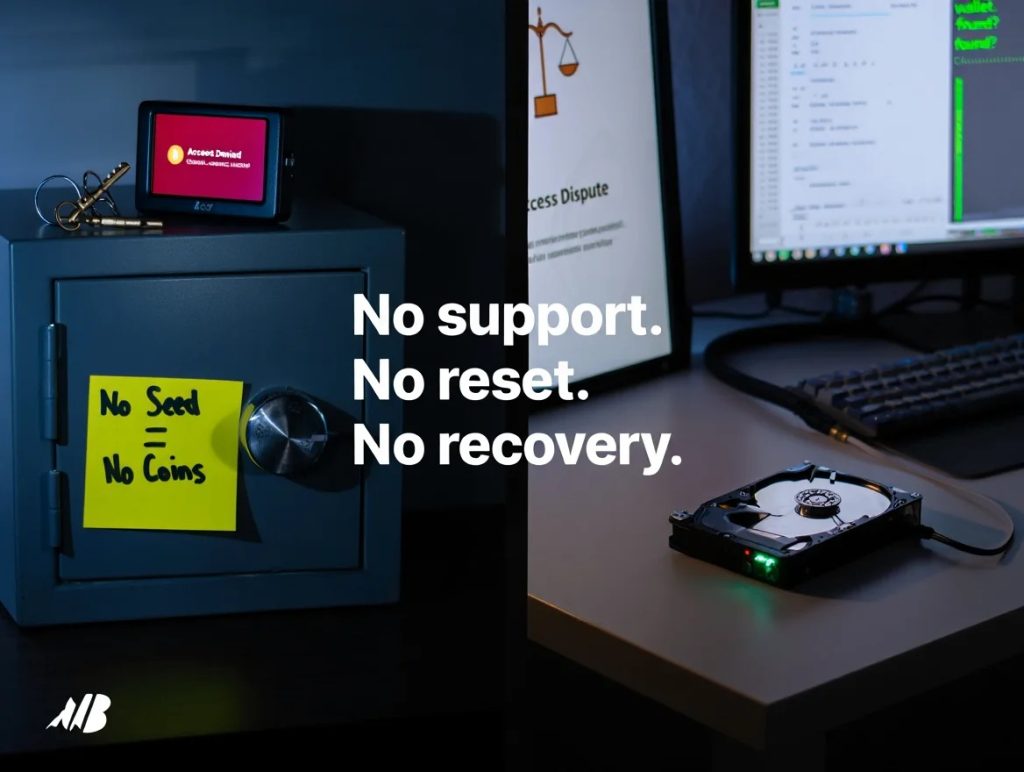

Bitcoin is not a bank. There is no customer support, reset button, or recovery hotline. If you lose your private key or recovery phrase, access to the funds is gone permanently.

This strict design protects users from third-party interference but also comes with personal responsibility. Once a key is lost:

This is why security experts often say: “Not your keys, not your coins.”

Despite how much Bitcoin has been lost to forgotten keys and hardware failures, there are rare cases where recovery has been possible — but only with a mix of luck, backups, and technical know-how.

Even in those cases, recovery is not guaranteed. Devices may be unreadable, corrupted, or incomplete. And legal ownership of recovered keys is sometimes disputed.

As Bitcoin becomes part of inheritance planning and divorce proceedings, legal systems are beginning to deal with the challenge of accessing lost or locked wallets.

Examples include:

There is currently no legal or technical mechanism to override Bitcoin’s cryptographic design. If a wallet is locked and the key is gone, the BTC inside it is effectively removed from circulation forever.

Understanding the scale and permanence of lost Bitcoins isn’t just trivia it offers powerful insights for anyone investing in crypto.

Whether you’re building your first wallet or managing a multi-asset portfolio, knowing what causes Bitcoin to disappear forever can help you avoid critical mistakes and shape smarter strategies.

The biggest takeaway is this: Bitcoin’s security is only as strong as your personal practices.

Lost keys are the number one cause of BTC loss and they’re fully preventable with a few simple steps.

Best practices include:

Failing to secure your wallet properly is like holding gold in your hand with no safe one mistake, and it’s gone.

While individual losses are unfortunate, the cumulative effect of millions of lost Bitcoins is a powerful economic force. It pushes Bitcoin’s effective supply lower than intended, which in turn strengthens its position as a deflationary asset.

For long-term holders, this offers unique upside:

In other words, every lost coin makes your remaining coins more valuable.

Several prominent voices in the crypto and financial community have weighed in on the impact of lost BTC:

Even mainstream economists are beginning to acknowledge that Bitcoin’s loss rate adds a layer of unintentional deflation, similar to physical gold being lost at sea or melted down irreversibly.

For investors, this means two things:

Learn more about knowledge:

As of 2025, as of 2025, the total lost Bitcoin is approaching 3.9 million coins, according to leading analysts, representing nearly 18.5% of the total supply.

In most cases, no. Once private keys or seed phrases are lost, the associated Bitcoins become inaccessible permanently.

Bitcoins are often lost due to forgotten private keys, discarded storage devices, mistyped addresses, or users passing away without inheritance plans.

Yes. Lost Bitcoins reduce the effective circulating supply, which contributes to increased scarcity and long-term upward price pressure.

Analytics firms like Glassnode and Chainalysis track long-dormant wallets, unspent transaction outputs, and provably burned addresses to estimate lost coins.

How much Bitcoin has been lost is not just a number, it’s a window into how scarcity is shaped in the Bitcoin ecosystem. As of 2025, an estimated 3.9 million BTC have been lost, never to be recovered. The amount of Bitcoin lost reinforces the idea of digital scarcity and should factor into every investor’s plan.

Here’s what we’ve learned:

Lost Bitcoin isn’t just gone, it’s what makes your Bitcoin more valuable. Don’t let poor security make your holdings part of the lost BTC count.

Stay informed, stay secure, and stay ahead.

Web Tai Chinh is a portal that updates news and information related to finance quickly and accurately, helping users have an overview before investing, clearly understanding concepts and terms related to Finance. Explore more insights in our Cryptocurrency category, start your crypto wallet development journey today with the right partner for long-term success.

📞 Contact: 055 937 9204

✉️ Email: webtaichinhvnvn@gmail.com

📍 Address: 13 Ho Tung Mau, An Binh, Di An, Binh Duong