Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Are you new to Bitcoin and often feel overwhelmed by its unpredictable price swings? Have you seen headlines about Bitcoin reaching record highs, only to drop suddenly the next day?

Don’t worry, you’re not alone. Many investors, both beginners and seasoned, constantly wonder: How much does a Bitcoin cost? As of today, one Bitcoin is priced at approximately $106,185 USD. But is it the right time to buy?

This article will guide you through the current Bitcoin price, why it fluctuates, and whether it’s a smart investment now. You’ll also discover:

Even if you’re just starting out, this guide will help you make clearer, more confident decisions in a volatile market. Let’s explore this essential topic together with Webtaichinh.

How much does a Bitcoin cost? The current Bitcoin price is highly volatile, shifting constantly in response to global market conditions, investor sentiment, and economic events. The Bitcoin cost now stands at roughly $106,185, but it’s subject to change within minutes

This price reflects a slight dip of -1.07% over the past 24 hours, a reminder of how quickly the crypto market can move.

Here’s a snapshot of the BTC price today, updated as of July 2, 2025.

| Metric | Value (as of July 2, 2025) |

| Current price (BTC/USD) | $106,185 |

| 24-hour change | -1.07% |

| Bitcoin market value | $2.11 trillion USD |

| 24-hour trading volume | $43.37 billion USD |

| Circulating supply | 19,886,246 BTC |

If you’re planning to buy or sell Bitcoin, keeping track of the live Bitcoin price is essential. Price changes can be driven by sudden events like policy shifts, major hacks, or institutional moves, and can drastically affect your entry or exit point.

Many traders rely on real-time price feeds from trusted platforms like:

These sources offer up-to-the-minute updates on price, volume, and order book depth crucial for high-frequency or short-term investors.

Several overlapping factors contribute to today’s market value:

Pro Tip: In my own portfolio strategy, I always compare BTC’s live price with broader market trends (like S&P 500 or USD strength) before making any buying decision. This context helps filter out noise and stay grounded in macro reality.

Understanding what moves Bitcoin’s price is essential before making any investment decision. While the number itself how much does a Bitcoin cost gives you a snapshot, it’s the why behind the number that helps you invest wisely. Below are the main forces shaping Bitcoin’s value today.

At its core, Bitcoin operates on a classic economic principle: scarcity.

For example, during the 2020–2021 bull run, rising demand from retail investors and institutional players like MicroStrategy caused BTC to soar over 600% in under a year.

Key takeaway: When demand spikes and supply remains fixed or tight, price tends to climb. When panic selling sets in, the reverse happens fast.

Bitcoin is increasingly being treated as a macro-sensitive asset. Several macroeconomic factors can directly influence its price:

In recent months, Bitcoin’s price action has moved closely in line with global inflation data and Federal Reserve comments, highlighting how intertwined crypto has become with traditional finance.

Nothing moves the Bitcoin market faster than government policy.

Recent regulatory updates can either fuel optimism or trigger sell-offs:

Investors should closely follow updates from key regulatory bodies, such as:

Pro insight: During the 2021 China mining ban, I witnessed a 30% drop in BTC’s price within weeks. However, long-term buyers used this opportunity to accumulate at lower prices a classic example of turning FUD into opportunity.

View more:

After exploring the current value and the forces that shape it, the next logical question is: Where is Bitcoin headed next? While no one can predict with certainty, expert forecasts offer valuable perspectives that can help you set realistic expectations and prepare your investment strategy.

Short-term Bitcoin forecasts often rely on technical analysis, market sentiment, and upcoming macroeconomic events.

Here’s what some leading analysts expect for Q3–Q4 2025:

Short-term prices are influenced by volatility, sentiment, and liquidity. Therefore, timing entries and exits becomes essential for active traders.

Long-term forecasts often incorporate Bitcoin’s supply model, adoption trends, and comparisons with gold or fiat debasement.

Some notable outlooks include:

These predictions are not guarantees, but they do reflect growing confidence in Bitcoin’s long-term value proposition, especially as it matures from a speculative asset to a global digital reserve.

Rather than chasing big price targets, ask yourself:

As an investor myself, I’ve learned that price predictions are best used to frame your mindset, not to set unrealistic expectations. Whether BTC hits $150K or falls to $80K, the key is knowing why you’re holding it.

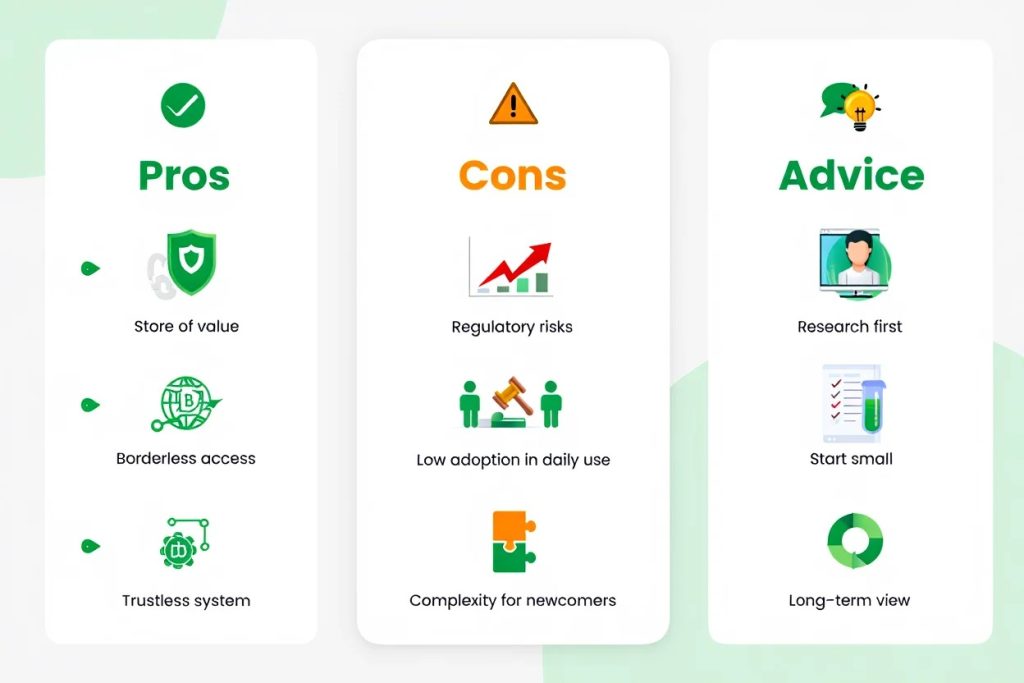

Now that you know how much does a Bitcoin cost and what influences its value, the key decision remains: Should you buy Bitcoin today? The answer depends on your financial goals, risk appetite, and market outlook. Below, we’ll break it down into pros, cons, and real-world experience to help you make an informed choice.

Here are some of the most compelling reasons investors are still buying Bitcoin in mid-2025:

I’ve personally held BTC since 2020 and despite cycles of fear and hype, it remains the best-performing asset in my portfolio over 5 years.

Despite its upside, Bitcoin also carries considerable risks:

If you’re investing short-term or without a plan, Bitcoin can feel more like speculation than strategy.

From my experience, successful Bitcoin investing depends more on mindset than timing. I made my first purchase in 2021 at ~$30,000 and added again in 2022 at ~$60,000, only to see the price crash below $20K.

But by staying calm, understanding the fundamentals, and dollar-cost averaging (DCA), my portfolio eventually recovered.

Here’s what top experts recommend:

Bitcoin isn’t a get-rich-quick scheme, but it can be a powerful long-term asset if you approach it with discipline and research.

Learn more about knowledge:

As of July 2, 2025, one Bitcoin costs approximately $106,185 USD. This price can change every minute depending on market activity.

$1 worth of Bitcoin equals approximately 0.00000942 BTC (based on a $106,185/BTC rate). The amount of Bitcoin you receive depends on the current exchange rate.

Bitcoin’s price is highly volatile due to market supply and demand, economic news, global regulations, and investor sentiment.

Bitcoin can be a good long-term investment if you understand the risks. Many experts recommend allocating only a small portion of your portfolio to crypto assets.

Use trusted platforms like Binance, TradingView, or CoinMarketCap for real-time Bitcoin price updates.

How much does a bitcoin cost is more than just a price check it’s the foundation for every decision you make in the crypto world. From real-time values to expert forecasts, and from macroeconomic trends to regulatory shifts, understanding Bitcoin’s price means understanding its role in the future of finance.

Let’s recap what you’ve learned:

If you’re ready to make smarter, more informed decisions about Bitcoin, staying updated is your best asset. Follow expert analysis, use live price tools, and don’t invest blindly.

Web Tai Chinh is a portal that updates news and information related to finance quickly and accurately, helping users have an overview before investing, clearly understanding concepts and terms related to Finance. Explore more insights in our Cryptocurrency category, start your crypto wallet development journey today with the right partner for long-term success.

📞 Contact: 055 937 9204

✉️ Email: webtaichinhvnvn@gmail.com

📍 Address: 13 Ho Tung Mau, An Binh, Di An, Binh Duong