Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

How to Almost Not Lose Forex Factory – Is it really possible to trade without blowing up your account? The truth is, you can’t avoid losses entirely in forex. But you can dramatically reduce them by mastering your mindset, leveraging the right tools, and applying proven risk management every single day. Most traders fail not because markets are unbeatable, but because they step in unprepared, over-leveraged, and emotionally charged.

This guide will walk you through exactly how to flip that script turning Forex Factory into your trading command center, cutting out bad habits, and stacking the odds in your favor. The goal? Protect your capital, survive longer, and thrive smarter.

At Webtaichinh, we’ll give you the practical steps and strategies used by experienced traders to “almost not lose” so you can focus on steady growth instead of constant recovery.

Key takeaways:

Before you learn how to almost not lose Forex Factory, you need to understand why the majority of forex traders fail in the first place. This isn’t just a warning it’s a roadmap of what to avoid.

Over 70% of retail forex traders lose money, and the reasons are surprisingly consistent. Most of them:

Enter trades without a tested strategy

Rely on gut feeling instead of data

Over-leverage their accounts chasing quick profits

React emotionally after losses, leading to impulsive decisions

The most damaging habits include revenge trading (increasing trade size after a loss), FOMO (jumping in too late), and abandoning plans under pressure. These behaviors often result in rapid drawdowns or even complete account blow-ups.

But here’s the truth: losing some trades is unavoidable. What separates long-term survivors from blown accounts is the ability to minimize losses, protect capital, and stay consistent. This is exactly what it means to “almost not lose.”

If you’re serious about learning how to almost not lose Forex Factory, you must first let go of the idea of perfection and replace it with discipline, patience, and control.

Next, let’s explore how to build the trader mindset that supports this approach.

Knowing how to almost not lose Forex Factory starts with managing the most unpredictable factor in trading your own psychology.

Even with the best tools and strategy, traders often sabotage themselves through emotional decisions. Fear, greed, and impatience are silent account killers. That’s why building a strong mindset isn’t optional it’s your first layer of protection.

Here are the most common psychological traps to avoid:

Revenge trading: Increasing position size after a loss to “win it back”

Overconfidence: Risking more after a few wins, assuming you can’t lose

FOMO: Entering late trades just because the market is moving fast

Paralysis by analysis: Overthinking and missing good setups due to fear

The solution isn’t to eliminate emotion but to build rules and routines that override it. To almost not lose in forex trading, you need to think like a risk manager, not a gambler.

Start with these mindset shifts:

Expect losses as part of the process not personal failure

Log your thoughts and behavior in a trading journal after each trade

Detach from outcomes focus on executing your plan, not being right

Build self-awareness through post-trade reviews, not just win/loss records

Traders who succeed long term don’t chase profits they protect their capital, manage their emotions, and learn from every outcome. That’s what “almost not losing” truly looks like in real-world forex trading.

In the next section, we’ll combine this mental edge with the practical tools on Forex Factory to help you trade with greater clarity and lower risk.

If you’re serious about learning how to almost not lose Forex Factory, you need to treat the platform as more than just a news site or forum. It’s a full-featured toolkit designed to help traders minimize risk and make smarter decisions.

Here’s how to use each of Forex Factory’s key tools to reduce unnecessary losses and increase your survival rate in the market:

The Forex Factory Economic Calendar shows upcoming economic events that often trigger sharp volatility interest rate decisions, CPI releases, NFP reports, and more.

To avoid being caught off-guard:

Filter by currency and impact level to focus only on relevant events

Avoid trading minutes before or after high-impact news releases

Use alerts to prepare in advance or temporarily close trades

Tip: Match your technical setups with periods of low expected volatility to improve trade accuracy and reduce slippage.

The Trade Explorer lets you analyze your live or demo account performance, offering data on:

Win rate, drawdown, and profit factor

Trade duration and behavior patterns

Which pairs or strategies are performing best or worst

Use it weekly to:

Detect overtrading or emotional patterns (e.g., holding losers too long)

Optimize position size and stop-loss logic based on real results

Stay objective about what’s working and what isn’t

This is one of the most underrated tools in learning how to almost not lose Forex Factory because it gives you a mirror into your real habits.

Forex Factory’s Sentiment tool shows how other traders are positioned. For example, if 80% of traders are long EUR/USD, the market may be overbought and due for reversal.

Here’s how to use sentiment wisely:

Avoid jumping into extreme sentiment positions

Combine with technical signals to confirm contrarian setups

Use it to gauge when crowd psychology is driving irrational price moves

Remember: most retail traders lose. If you’re always on the same side as 80% of them, that’s a red flag.

Choosing the wrong broker can ruin your trading journey before it begins. The Broker Comparison section on Forex Factory helps you:

Check regulatory status and avoid scam platforms

Compare spreads, execution quality, and commissions

Read real trader reviews for transparency

Don’t get lured in by flashy bonuses or low minimum deposits. Focus on safety, reliability, and cost efficiency.

When used together, these tools give you a powerful advantage in the market. They help you filter noise, time your trades more precisely, and track performance with honesty.

Mastering how to almost not lose Forex Factory means using every edge available and these tools are your tactical foundation.

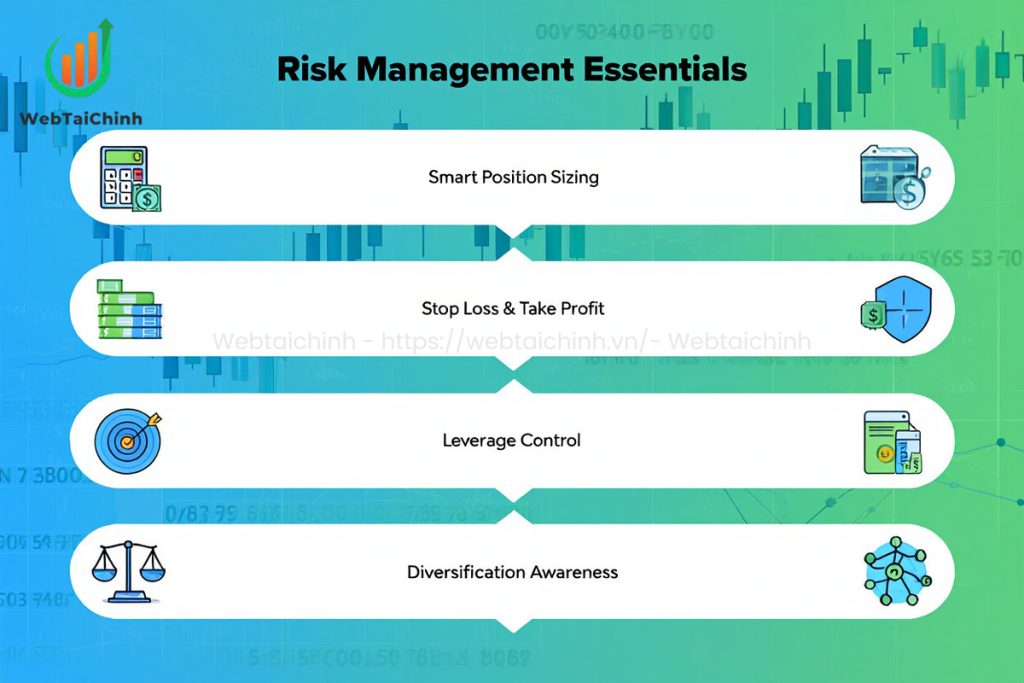

No matter how good your analysis is, without risk control, you will eventually blow your account. That’s why every trader serious about how to almost not lose Forex Factory must treat risk management as a non-negotiable priority.

Here are the four pillars of effective forex risk management:

One of the most effective ways to protect your capital is to limit how much you risk on each trade, especially when understanding concepts like what is free margin forex.

Example:

Account balance: $5,000

Risk per trade: 2% = $100

Stop loss: 50 pips

→ Your position size must ensure that a 50-pip loss equals no more than $100

Tool tip: Use Forex Factory’s community-shared position size calculators or spreadsheets.

Too many traders either skip stop losses or place them arbitrarily. Instead:

Use technical levels (support/resistance, ATR) to set stop loss

Maintain a risk:reward ratio of at least 1:1.5 or better

Avoid moving stops emotionally during trades

Remember: Stop losses protect your future ability to trade not just your current position.

High leverage can magnify profits but also accelerate losses. If you’re learning how to almost not lose Forex Factory, keep leverage conservative:

For beginners: 1:10 to 1:30

For experienced traders: max 1:50 (with strict risk controls)

Using lower leverage gives your strategy room to breathe and prevents margin calls during drawdowns.

Avoid risking too much on highly correlated pairs like EUR/USD and GBP/USD at the same time. When both move together, your exposure is doubled.

Tips:

Trade across uncorrelated currencies

Don’t risk more than your total daily risk cap across all positions

Review your exposure by instrument type and news sensitivity

Quick risk management checklist

Consistency in trading doesn’t come from luck it comes from structured habits. If you’re trying to master how to almost not lose Forex Factory, building a disciplined daily routine is non-negotiable.

Below is a simple yet powerful 3-step routine that can help protect your capital, improve your decision-making, and boost long-term performance.

Before placing any trades, take 15–20 minutes to plan your session:

Check the Economic Calendar on Forex Factory: Identify high-impact events that could affect your pairs.

Review the sentiment tool: Look for extreme positions or crowd traps.

Scan key forum discussions: Get a sense of what experienced traders are watching.

Open your trading journal: Reflect on any recent mistakes you want to avoid repeating today.

This phase sets the tone for a controlled, intentional trading session rather than one driven by emotion or impulse.

When you’ve identified a valid setup:

Set entry, stop loss, and take profit levels in advance

Calculate position size to stay within your risk tolerance

Place alerts for key price levels if you’re waiting to enter

Stick to your rules don’t override your plan mid-trade

If you’re testing a new strategy, use demo accounts linked to Trade Explorer to monitor results before going live.

At the end of your trading day:

Log each trade in your journal: entry, exit, result, and emotional state

Use Trade Explorer analytics to identify performance patterns

Adjust your strategy based on recurring errors or unexpected results

Bonus tip: Dedicate 30 minutes weekly to deep review. Group trades by outcome, setup type, or emotional behavior to spot trends you might miss day to day.

Related reads to deepen your knowledge:

It means minimizing avoidable losses through proper mindset, risk control, and tool usage—rather than aiming for zero losses. Traders who understand how to almost not lose Forex Factory focus on capital preservation, not perfection.

Start each day by checking the Economic Calendar, reviewing sentiment, and analyzing past trades. Then execute planned setups with strict position sizing and end your session with a post-trade journal review.

While all tools are valuable, the Trade Explorer stands out. It provides deep insights into your performance patterns, helping you make data-driven improvements and avoid emotional decision-making.

Base your stop loss on technical levels (like support/resistance) or volatility indicators like ATR—not gut feeling. This improves trade longevity while still controlling maximum risk exposure.

Forex Factory offers excellent tools, but consistent profitability requires more: a disciplined mindset, strict risk management, and a repeatable trading routine. When combined, that’s how you almost not lose Forex Factory.

Learning how to almost not lose Forex Factory isn’t about finding a magic indicator or copying someone else’s trades. It’s about developing the right mindset, using the right tools, and following the right habits consistently.

Here’s what you’ve learned:

Your action checklist:

Success in forex isn’t about never losing. It’s about not losing big, and not losing often. That’s what “almost not losing” really means and it’s the edge that keeps traders in the game while others burn out.

What part of your trading routine do you find hardest to stick to?

Leave a comment or question we’re here to help you trade smarter, not harder.

Web Tai Chinh is a portal that updates news and information related to finance quickly and accurately, helping users have an overview before investing, clearly understanding concepts and terms related to Finance. Explore more insights in our Forex category, start your FX trading journey today with the right partner for long-term success.

📞 Contact: 055 937 9204

✉️ Email: webtaichinhvnvn@gmail.com

📍 Address: 13 Ho Tung Mau, An Binh, Di An, Binh Duong