Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

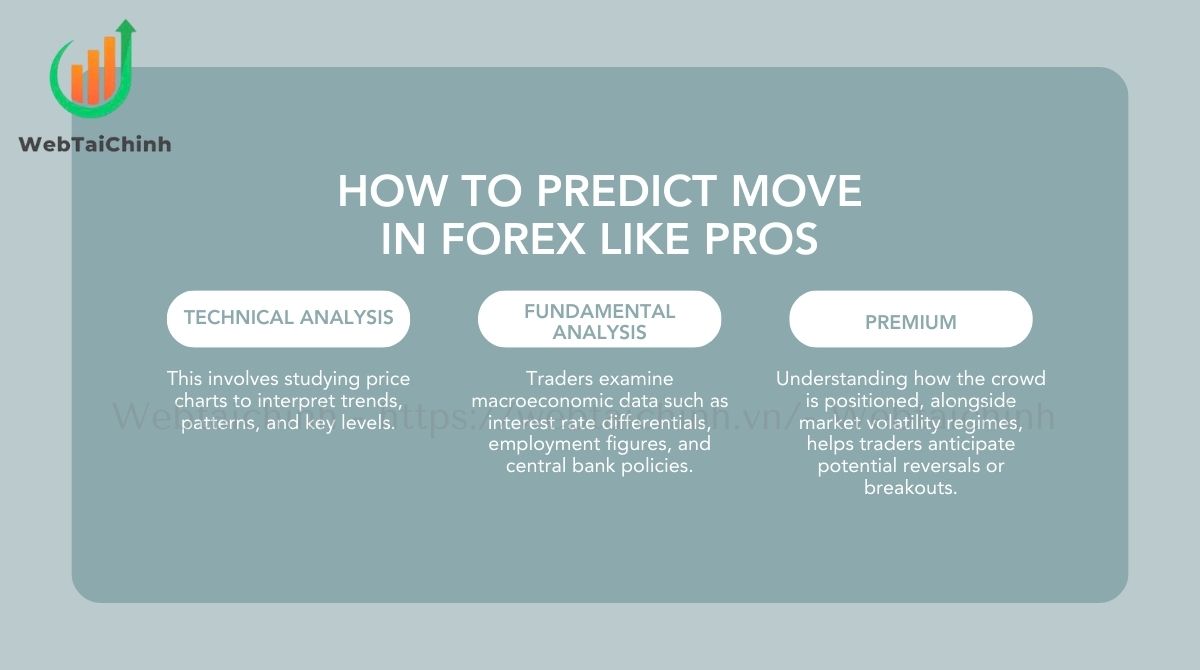

Mastering how to predict move in forex is the ultimate goal of every trader who wants consistency and confidence in the market. While no one can foresee the future with certainty, professionals rely on proven methods to build strong trade theses and reduce uncertainty.

By combining technical analysis, fundamental drivers, and sentiment insights, traders can anticipate market shifts more effectively and develop strategies that stand the test of time.

Professional forex traders rely on three interconnected pillars to boost the accuracy of their market predictions.

Integrating these pillars improves the probability of success by providing a 360-degree view of the market. However, traders must guard against common pitfalls like overconfidence, trading during major news without a plan, and neglecting risk controls.

Top risks to avoid:

Technical analysis is the cornerstone of forex trading, focusing on price action to identify potential opportunities. Here’s a step-by-step framework to get you started:

Example setup: Imagine a bullish trend confirmed by a 50-day moving average and RSI rising above 50. A pullback to support with increased volume might serve as an entry point, placing a stop below the recent swing low to manage risk.

Remember, technical analysis provides a framework but should be validated against fundamental and sentiment indicators for highest conviction.

Fundamental factors offer insight into the economic backdrop influencing currencies. Key drivers include:

Routine practice: Use economic calendars (e.g., ForexFactory, Investing.com) to track key events. Keep a macro diary capturing pre-event biases and post-event market reactions. Recognize “surprise vs. consensus” outcomes as these often trigger sharp currency moves.

No-trade windows: Avoid entering new positions right before major news releases to sidestep unpredictable volatility spikes.

| Event | Typical currency reaction |

| FOMC Statement | USD often spikes or drops sharply depending on tone |

| Nonfarm Payrolls (NFP) | USD volatility increases; strong jobs data strengthens USD |

| ECB Rate Decision | EUR moves sharply in hawkish/dovish scenarios |

Combining these fundamental insights with confirming technical setups leads to the strongest trade convictions.

Market sentiment reflects how traders collectively feel and position themselves. It shapes price movements often beyond pure economic logic.

Sentiment indicators: Reports like the Commitment of Traders (COT), retail positioning data, and institutional sentiment surveys reveal crowd psychology.

Volatility regimes: Different market conditions—calm, moderate, or highly volatile—affect how you should size positions and set stops. Use tools like ATR, implied volatility measures, and indices like VIX and FX Volatility Index to monitor regimes.

Modifying strategy: Higher volatility often warrants wider stops and smaller position sizes; lower volatility may allow more aggressive entries.

6-Step sentiment/volatility pre-trade checklist:

Example: A “volatile week” with extreme bullish sentiment may warn of an impending correction despite positive technical signals.

Aligning sentiment and volatility with your technical and fundamental analysis ensures you trade with market conviction and appropriate caution.

Executing consistent trades requires synthesizing all three pillars into a clear trading thesis.

Mini case study: Suppose EUR/USD is in an uptrend confirmed by technical indicators, the ECB signals a hawkish stance in the upcoming meeting, and sentiment shows moderate retail short positions. Plan entry at breakout confirmation, set stops below key support, and manage position size per volatility. Track the trade progress, journal your thesis, and adjust accordingly.

This disciplined workflow builds consistency and aids learning from each trade.

Smart risk management preserves capital and ensures longevity in forex trading. Follow these rules:

Read more: What is buy limit in forex? Complete beginner’s guide

Example Calculation: If your stop is 50 pips on USD/JPY and you risk 1% of a $10,000 account, position size should be 0.2 standard lots to control loss within $100.

| Mistake | Solution |

| Ignoring volatility in position sizing | Adjust trade size using ATR-based stop distances |

| Skipping stop loss | Always use stops just beyond key support/resistance |

Good risk management paves the way for sustainable forex profits.

Algorithmic and AI models have become popular tools for forex forecasting. Common model types include:

Pros:

Cons:

| Human Workflow | Model Prediction |

| Incorporates news, sentiment, discretionary adjustments | Focused on historical price data and statistics |

| Flexible during unforeseen events | Can fail during regime shifts |

| Better risk management integration | Requires separate risk modules |

While AI can augment decision making, it doesn’t replace the nuanced judgment required in real-world forex trading.

Read more:

There is no single “best” indicator. A combination works best — moving averages for trend identification and MACD or RSI for momentum confirmation are widely recommended.

AI can assist in forecasting by analyzing large datasets, but accuracy is limited by market complexity and unforeseen events. It cannot guarantee precise predictions.

Trading during news can be profitable but carries high risk due to volatility spikes. Many traders prefer to wait for confirmed setups after news events to reduce uncertainty.

Currency pairs move primarily due to interest rate differentials, economic data surprises, central bank policies, and shifts in market sentiment.

This is the difference between two countries’ interest rates, influencing capital flows and currency strength.

Understanding how to predict move in forex requires more than just looking at charts. It’s about integrating multiple perspectives—technical signals, economic fundamentals, and market sentiment—into a cohesive trading plan. With discipline, risk management, and continuous learning, traders can turn uncertainty into opportunity. For more in-depth strategies and expert insights, explore our guides at webtaichinh.

Web Tai Chinh is a portal that updates news and information related to finance quickly and accurately, helping users have an overview before investing, clearly understanding concepts and terms related to Finance. Explore more insights in our Forex category, start your FX trading journey today with the right partner for long-term success.

📞 Contact: 055 937 9204

✉️ Email: webtaichinhvnvn@gmail.com

📍 Address: 13 Ho Tung Mau, An Binh, Di An, Binh Duong