Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

How to start a forex brokerage firm without burning time and capital on avoidable compliance, banking, and liquidity pitfalls? The short answer: pick a jurisdiction and license that match your target clients, secure reliable banking and payment rails, and launch on a tech stack that passes audits from day one.

If you’re wrestling with regulatory complexity, de‑risking banks, or opaque liquidity costs, this guide cuts through the noise and shows a sequenced path to launch and scale. You’ll get actionable steps on licensing, bank/PSP setup, platform selection (MT5, cTrader, or white label), liquidity aggregation, and risk controls so you can move fast without tripping over compliance.

Ready to build a brokerage that’s audit‑ready and revenue‑focused? Let’s dive in Webtaichinh will walk you through it and point out the costly traps to avoid.

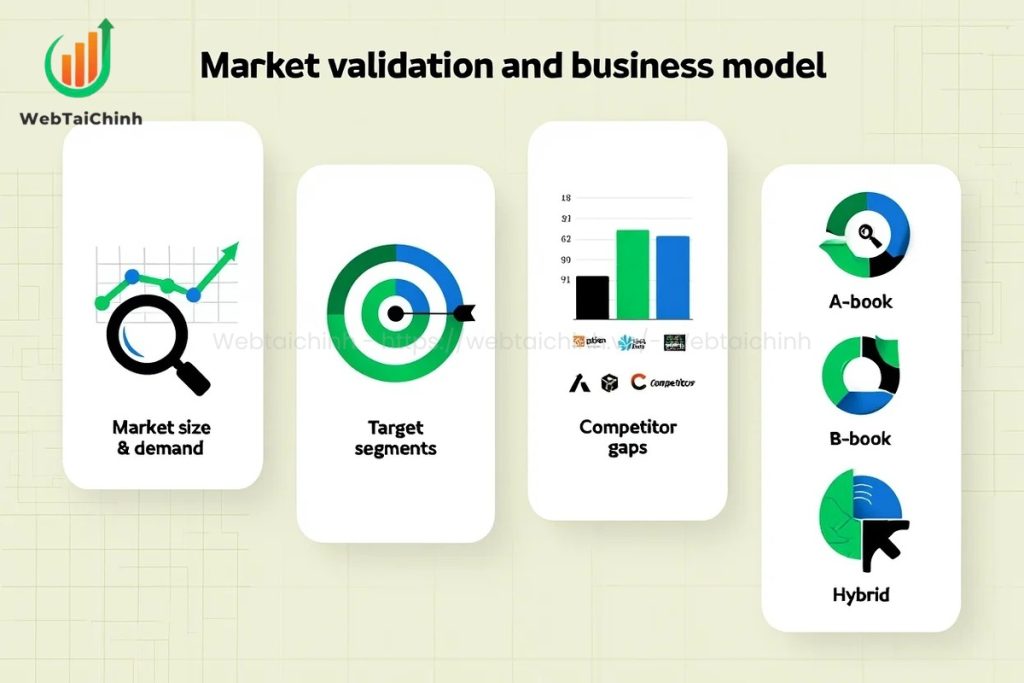

How to start a forex brokerage firm begins with validating your target market and selecting a sustainable business model. Without a clear understanding of demand, competition, and your own operational capacity, you risk building an expensive structure with no clear path to profitability. This section lays the groundwork to identify the right clients, choose the most effective execution model, and position your brokerage for competitive advantage.

In 2025, the forex market processes over $7 trillion in daily transactions, offering unprecedented liquidity and diverse trading opportunities. Target segments can include:

Retail traders: Seek intuitive platforms, low spreads, and quick onboarding.

Professional traders: Require advanced charting, API connectivity, and tight execution times.

Institutional clients: Focus on deep liquidity, tailored reporting, and dedicated account management.

Competitor analysis should go beyond product features examine their pricing models, customer support quality, geographic focus, and marketing channels. Identifying gaps (e.g., underserved crypto-forex integration, niche language support) provides an opening for differentiation.

Choosing your trade execution model directly impacts revenue and risk:

A-book (STP): Orders go directly to liquidity providers, reducing conflict of interest but lowering margins.

B-book (Market Making): You take the other side of client trades, offering higher profit potential but increased exposure and regulatory scrutiny.

Hybrid: Allocates flow between A-book and B-book depending on client profile or market conditions.

A clear routing policy backed by risk analytics ensures transparency and mitigates disputes.

Your revenue structure can combine variable spreads, fixed spreads, and commissions. A competitive yet profitable approach might involve:

Narrow spreads for high-volume clients to increase retention.

Commission tiers for Introducing Brokers (IBs) and affiliates.

Transparent swap/rollover policies for overnight positions.

Always benchmark against leading brokers in your chosen segment to avoid pricing yourself out of the market.

A structured SWOT analysis helps align strengths with market opportunities:

Strength: In-house blockchain expertise for crypto-forex integration.

Weakness: Limited initial brand recognition.

Opportunity: Rising demand for multi-asset trading platforms with DeFi access.

Threat: Regulatory tightening in key jurisdictions.

Your Unique Selling Proposition (USP) could be ultra-fast execution, multilingual 24/5 support, or AI-powered trading analytics. Define this early it will shape both your marketing and your operational priorities.

How to start a forex brokerage firm responsibly begins with choosing the right jurisdiction, securing the appropriate license, and operationalizing a compliance program that actually scales. This section gives you a step‑by‑step view from where to incorporate to how to pass audits so you can launch without regulatory surprises.

Start with a shortlist that balances speed, credibility, and cost. Broadly:

Top‑tier regulators (e.g., FCA, ASIC, MAS): Longer approval windows, higher capital and governance standards, strong client‑money rules, and frequent audits. The trade‑off is maximum trust with banks, PSPs, and institutional clients.

EEA/Cyprus (CySEC) or similar: Competitive timelines, passporting options, established supervision, and decent brand recognition in retail markets.

Offshore (e.g., Seychelles, Mauritius): Faster setup and lower fees, but typically lighter client‑protection regimes and more vendor due‑diligence required to open bank and PSP lines.

Decision checklist:

Regulatory timeline and track‑record with new applicants

Minimum paid‑up capital and ongoing capital ratio tests

Client money (segregation) rules and reconciliation frequency

Audit cadence (annual vs. enhanced), reporting portals, and on‑site inspections

Banking/PSP openness to entities from that jurisdiction

Select an entity structure that supports licensing and tax planning (e.g., HoldCo for IP and treasury; OpCo for regulated activities). Expect to provide:

Directors and key function holders with verifiable experience in brokerage, risk, and compliance; often residency or local presence is required.

Fit‑and‑proper evidence: clean criminal/credit checks, reference letters, certified IDs, and detailed CVs.

Policies and manuals: compliance, best execution, conflicts of interest, business continuity, complaints handling.

Financials: opening balance sheet, 12‑ to 24‑month capital and liquidity plan, and audited accounts if available.

Tip: Build a governance calendar (board meetings, policy reviews, ICAAP/ILAAP where applicable) before submission regulators look for forward discipline, not just initial paperwork.

Design your AML program as an operating system, not a document set:

Onboarding: risk‑based KYC/KYB, liveness and document checks, PEP/sanctions screening, source‑of‑funds where indicated.

Transaction monitoring: rules and models that flag velocity, layering, unusual size/frequency, and cross‑border patterns; tune for false‑positive control.

Case management: clear escalation paths to MLRO, investigation notes, and SAR/STR filing procedures.

Periodic review: refresh KYC by risk tier; re‑screen sanctions lists automatically; capture adverse media changes.

Recordkeeping: immutable logs, evidence of decisioning, and retention in line with local regulations.

Embed customer disclosures (fees, risks, execution policy) into onboarding and ensure marketing approvals are logged financial promotions must match what operations can deliver.

Operationalize compliance in your back office:

Registers: complaints, conflicts, gifts/inducements, breaches, incidents, PA dealing.

Regulatory reporting: capital adequacy, client‑money reconciliations, transaction/EMIR‑style reports where applicable, and audit packs prepared in advance.

Website disclosures: license number, legal entity, client‑money segregation statement, risk warnings, fees/charges schedule, and policy links (best execution, privacy, cookies).

Change management: product changes, new jurisdictions, or remuneration schemes should trigger compliance sign‑off and, if needed, prior notification to the regulator.

Pro move: Create a “readiness binder” (digital) that mirrors an on‑site exam: org charts, policy versions, training logs, samples of reconciliations, complaint closures, and marketing approvals. It cuts audit friction and builds trust from day one.

How to start a forex brokerage firm the right way means locking down bank/PSP rails that are reliable, global, and regulator‑proof from day one. This section shows how to open accounts, design a resilient PSP stack, and implement safeguarding with airtight reconciliations so client money is always protected.

Open at least two corporate operating accounts (primary + contingency) in the jurisdiction of license or a well‑rated correspondent hub. Expect enhanced due diligence (EDD): certified corporate docs, licensing trajectory, source of funds, projected flows by corridor, key‑person IDs, and compliance manuals.

Bank selection criteria: appetite for FX/CFD businesses, multi‑currency support, API access for statements, cut‑off times, and SLA for investigations/recalls.

Account structure: OpEx account, client money trust/segregated account, and a small buffer account for chargebacks/fees.

Onboarding tips: provide a 12‑month cash‑flow model, sample reconciliations, and a transaction narrative (average ticket, peak volumes, geographies). This reduces perceived AML/chargeback risk and speeds approval.

learn more about: ticker meaning crypto

Build a redundant PSP mesh so deposits and withdrawals don’t stall when one rail is down. Use a lightweight orchestration layer (in‑house or vendor) to route by card scheme, currency, region, and fraud score.

Minimum viable stack: 1 card acquiring PSP + 1 APM (e.g., local bank transfer) + 1 cross‑border payout rail.

Controls: 3‑D Secure where applicable, velocity limits, device fingerprinting, IP/geo checks, name‑on‑card vs KYC name match, and rolling reserve negotiation for new merchants.

Coverage: SWIFT for cross‑border, SEPA/Faster Payments for EEA/UK, plus popular local methods in target markets.

Ops must‑haves: automated settlement file ingestion, fee mapping by MID, and exception queues (retries, partial captures, duplicate detection).

Segregate client money in designated accounts and document the flow end‑to‑end (deposit → platform wallet → margin usage → withdrawal).

read more:

Daily client‑money reconciliation: platform ledger vs bank/PSP statements; investigate breaks the same day.

Journal discipline: timestamped entries for deposits, withdrawals, fees, swaps, and corporate transfers; no co‑mingling.

Withdrawal policy: risk‑based checks (KYC refresh, PEP/sanctions re‑screen, trade abuse flags) with two‑person approval for high‑value payouts.

Disclosure: publish safeguarding statement, fee schedule, and processing timelines on your site; align ops with what you advertise.

Run treasury like a mini bank: protect liquidity for client withdrawals and LP margin while minimizing FX cost.

Liquidity ladder: T+0 (ops cash), T+1–T+7 (expected settlements), and contingency reserves for market stress/chargebacks.

Currency management: pre‑fund major corridors, net internally where possible, and hedge operational FX if exposure is material.

Counterparty limits: set exposure caps per bank/PSP based on credit rating and historical uptime; monitor concentration risk.

Access controls: role‑based permissions, maker–checker on payments, hardware tokens for sign‑off, and immutable audit trails.

Two banks approved; client‑money account live and ring‑fenced.

At least two PSPs in production with failover routing tested.

Daily reconciliation runbook + break‑resolution SLA (same‑day).

Withdrawal KYC/AML playbook and escalation matrix documented.

Treasury policy: liquidity ladder, currency limits, and sign‑off rules.

Dialing in these rails is non‑negotiable in how to start a forex brokerage firm they underpin client trust, regulator confidence, and your ability to scale without payment bottlenecks

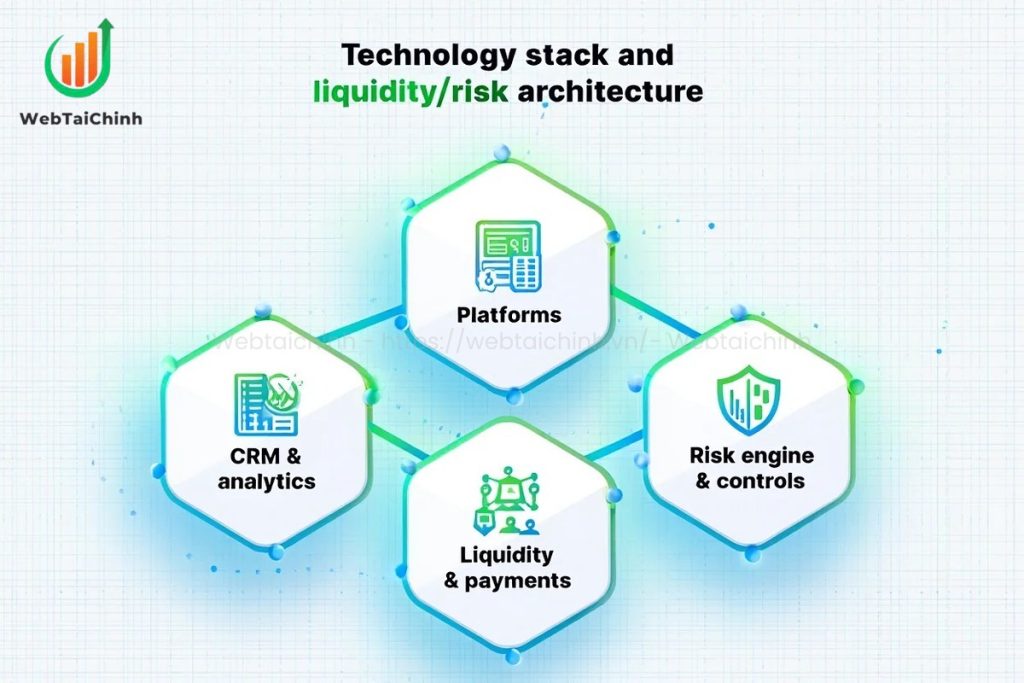

How to start a forex brokerage firm at scale hinges on two things: a resilient trading stack and a sober risk architecture. This section helps you choose platforms, wire up back‑office/CRM, integrate KYC/AML and payments, and design liquidity + risk controls that survive real‑world volatility.

Pick a route that matches your capital, roadmap, and target users.

MT4/MT5 full license: Maximum control, proven ecosystem (EAs, indicators), robust FIX/bridge compatibility. Higher capex/opex, longer certification.

cTrader: Modern UI/UX, strong depth‑of‑market, API flexibility; good for pro/ECN positioning.

White label (any): Fastest go‑live, lower upfront cost, vendor handles upgrades/hosting. Less control over roadmap and margins (rev‑share/minimums).

Proprietary build: Own the experience and unit economics; requires product discipline, market data agreements, security audits, mobile parity, and years of burn.

Selection criteria: latency (<50–100 ms to LP hub), stability (≥99.95% monthly uptime), mobile parity, FIX 4.4/WebSocket support, plugin marketplace, and vendor audit transparency (SOC 2/ISO 27001).

Your platform is only as good as your ops spine.

CRM/BO: KYC status, risk tier, balances, leverage, PnL, IB/affiliate tracking, and ticketing in one pane.

Reconciliations: Auto‑ingest statements (banks/PSPs/LPs), normalize fees, daily client‑money checks, exception queues with SLAs.

Reg reporting: Export packs for audits (capital, complaints, best‑execution), configurable trade and client logs, immutable change history.

Analytics: Cohorts (ARPU, LTV, churn), spread leakage, slippage heatmaps, LP hit ratios, and funnel drop‑offs (KYC abandonment). Instrument everything if it moves, measure it.

KYC/AML: Liveness, document OCR, sanctions/PEP, adverse media, device/IP intel, risk‑based refresh; case management with SAR/STR workflow.

Payments: Orchestrate multiple PSPs with routing by BIN/currency/geo and fraud score; support SWIFT/SEPA/faster rails; auto‑reconcile settlements.

Bridge/Aggregator: FIX to multiple LPs/ECNs; features to require: smart order routing (TOB/VWAP), watchdogs for stale quotes, last‑look monitoring, and auto‑failover. Keep LP connectivity in separate zones from client‑facing web so incidents don’t cascade.

Design risk before the first trade:

Routing policy: A‑book toxic/high‑freq/latency‑arb flows; B‑book low‑risk cohorts; hybrid rules by client score, symbol, and session. Document it.

Hedging: Net exposure to LPs by symbol/tenor; sweeps on thresholds; inventory caps; spread/commission guardrails to avoid negative economics.

Pre‑trade checks: margin validation, max order size/notional, price bands vs reference, throttles per account/IP/device.

Surveillance: spoofing/layering flags, off‑market fills, cancel/replace velocity, weekend gap abuse, bonus abuse.

Stress and chaos tests: historical (CHF‑style) replays, quote‑freeze drills, LP outage failovers, kill‑switch exercises.

SLOs & DR: ≥99.95% uptime, RPO ≤ 5 min, RTO ≤ 15 min; active‑active regions where possible; quarterly failover rehearsals with signed minutes.

Security is non‑negotiable in how to start a forex brokerage firm:

Controls: MFA everywhere, least‑privilege IAM, PAM for finance ops, HSM‑backed key storage, secrets rotation, WAF + rate‑limits, DDoS plan.

Data: Pseudonymize PII at rest (AES‑256) and in transit (TLS 1.3), field‑level access, audit trails immutable (WORM).

Secure SDLC: SAST/DAST, dependency scanning, pen tests at least annually, vendor SOC/ISO evidence, SBOM for proprietary code.

Privacy: GDPR/CCPA notices, data‑subject workflows, retention schedules, breach playbook with comms templates.

How to start a forex brokerage firm isn’t just about getting licensed and setting up tech it’s also about attracting the right clients, converting them efficiently, and running day-to-day operations without breakdowns. This section covers brand positioning, acquisition channels, retention levers, and the operational backbone you’ll need to execute 24/5.

Your brand is the first compliance check in a client’s mind.

Trust signals: regulator license number, client-fund segregation statement, audited financial summaries, and partnerships with recognized LPs or PSPs.

Website IA: friction-free navigation, clear risk warnings, fee schedules, and multilingual content.

Platform demo flow: instant access to demo accounts without full KYC, but with clear prompts to upgrade; use demo-to-live conversion tracking.

Visual identity: consistent typography, responsive design, and color palettes that reflect professionalism, not gimmicks.

SEO: target transactional queries (“open forex account”, “tight spreads broker”) and informational queries (“how to start a forex brokerage firm”, “forex trading platforms”). Publish thought-leadership content and regulatory updates to build EEAT.

PPC: bid on high-intent keywords; use geo-targeting to comply with licensing limits.

Affiliates/IBs: define payout tiers by lots traded or active clients; monitor in real time; require signed contracts and KYC for all partners.

Fraud controls: track abnormal referral spikes, duplicate device IDs, and high churn from specific affiliates.

Smooth onboarding is a competitive edge:

Use progressive KYC: basic info first, then proof of identity/address, then enhanced checks for higher risk tiers.

Offer multiple KYC methods (mobile upload, webcam capture, in-person verification partners).

Display status bars and expected completion times to reduce abandonment.

Automate follow-ups via email/SMS when clients stall mid-process.

Core launch roles:

Compliance officer (MLRO)

Risk/dealing desk

IT/DevOps support

Marketing manager

Client support team (multilingual)

SOPs: document trade execution, incident escalation, PEP/sanctions hit handling, client complaint resolution, and DR failover.

Vendor SLAs: define uptime, response time, and penalty clauses with tech, LP, and PSP partners.

Incident response: assign incident commanders, maintain comms templates, and keep logs for regulatory review.

Education: webinars, daily market briefs, platform tutorials.

Loyalty tiers: reduced spreads/commissions, exclusive market analysis, or priority withdrawal processing for high-value clients.

Community: moderated forums, social channels, and IB networking events.

Service quality: 24/5 support in target languages, first-response SLAs under 60 seconds for chat and under 2 minutes for calls.

Related reads to deepen your knowledge:

The capital requirement depends on your licensing jurisdiction. Offshore licenses may start from around $20,000, while top-tier regulators like the FCA or ASIC can require $100,000–$1 million in paid-up capital plus ongoing capital adequacy ratios.

Timelines range from 1–3 months for offshore jurisdictions to 6–12 months for highly regulated markets like the UK or Australia. The process includes due diligence, capital verification, and compliance audits.

Not necessarily. Many brokers choose jurisdictions that align with their target markets, banking access, and regulatory requirements. However, you must ensure your license allows you to operate in the countries you target.

It depends on your risk appetite and resources.

A-book passes trades directly to liquidity providers, reducing conflict of interest but limiting margins.

B-book keeps trades in-house for higher profit potential but requires strict risk controls.

Hybrid blends both, routing orders based on client profile and market conditions.

A combination of SEO, paid ads, affiliate programs, and strong brand trust signals works best. Offering competitive spreads, responsive multilingual support, and a smooth onboarding process also improves conversion rates.

How to start a forex brokerage firm successfully in 2025 requires more than just obtaining a license it demands solid market research, the right legal structure, reliable banking and payment rails, a robust technology stack, and effective marketing strategies. By following each step in this guide, you can build a brokerage that is both compliant and competitive in the fast-moving forex industry.

Quick checklist:

What unique edge will you bring to your brokerage? Share your ideas or questions in the comments so we can discuss them together.

Web Tai Chinh is a portal that updates news and information related to finance quickly and accurately, helping users have an overview before investing, clearly understanding concepts and terms related to Finance. Explore more insights in our Forex category, start your FX trading journey today with the right partner for long-term success.

📞 Contact: 055 937 9204

✉️ Email: webtaichinhvnvn@gmail.com

📍 Address: 13 Ho Tung Mau, An Binh, Di An, Binh Duong