Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Is forex trading halal or haram in 2025? This question continues to spark debate among Muslim investors worldwide. Forex, the global currency market, is highly liquid and accessible, but its practices often intersect with key Islamic finance principles such as riba (interest), gharar (uncertainty), maysir (gambling), and baiʿ al-ṣarf (currency exchange rules).

In this guide, we provide a clear short answer, break down Sharia perspectives, and share practical guidelines for traders who want to ensure their strategies align with Islamic law.

Key takeaways:

Forex trading can be considered halal if conducted strictly within the boundaries set by Islamic Sharia law. Conversely, it becomes haram when those guidelines—particularly those concerning interest (riba), gambling (maysir), excessive uncertainty (gharar), and currency exchange rules (baiʿ al-ṣarf)—are violated.

Simply put, forex is permissible only when trades avoid forbidden practices such as interest-based swaps, speculative gambling, and contracts with ambiguous terms.

Disclaimer: This summary does not replace personal consultation with qualified Islamic scholars. For detailed fatwas, refer to official bodies such as the International Islamic Fiqh Academy and local muftis to consider your specific context.

Next, we will explore the Sharia principles that underpin these conditions, clarifying why they matter in currency trading.

Islamic finance principles emphasize fairness, transparency, and prohibition of exploitative practices. Four key concepts help determine whether an activity is halal or haram in currency trading:

| Sharia concept | Meaning | Relevance to forex |

| Riba (Interest) | Any guaranteed interest on loaned money, considered unjust gain. | Swap or rollover fees in forex accounts that are interest-based violate this principle. |

| Gharar (Excessive Uncertainty) | Uncertainty or ambiguity in contract terms leading to dispute or injustice. | Delayed settlement or unclear trade conditions in forex can involve gharar. |

| Maysir (Gambling) | Games of chance or speculation that involve winning/losing by luck. | Pure speculation or betting on price movements without real ownership is akin to gambling. |

| Baiʿ al-Ṣarf (Currency Exchange Rules) | Islamic rules mandate that currency exchange must be immediate and on the spot. | Forward contracts or trades with deferred payment violate baiʿ al-ṣarf. |

Each of these principles ensures financial dealings remain ethical, transparent, and free from exploitation. Forex platforms may involve one or more of these elements, so understanding their operation is critical for halal compliance.

There are numerous contexts in forex trading that can render it haram. Here is a list of common red flags, each explained with examples and scholarly rationale:

Mini-Scenario: Consider a trader holding a USD/JPY position overnight on a standard account where the broker applies a rollover interest fee. Since Islam forbids profiting from interest, this action renders the trade haram unless swapped for an Islamic account with no interest charges.

Understanding these prohibitions helps traders avoid unlawful practices. Next, we will cover how to trade forex permissibly.

Muslim traders can engage in forex trading within the following compliance framework:

Accepted halal trading scenarios include day trading spot FX within a properly documented Islamic account or short-term holding with no interest or hidden fees. Transparent terms and conditions are essential to uphold Sharia compliance.

Next, we examine how different forex products are viewed under Islamic law.

| Instrument | Sharia ruling | Why | Notes/Exceptions |

| Spot FX | Generally halal | Immediate exchange fulfilling baiʿ al-ṣarf | Requires swap-free accounts to avoid riba |

| Forward FX | Haram | Delayed settlement violates immediate exchange rule | Except rare, well-structured Islamic contracts |

| FX options/Swaps | Contested; mostly haram | Involve gharar and speculation | Some exceptions if structured Sharia-compliant |

| CFDs (Contracts for difference) | Highly debated | Considered synthetic, often involve gharar and riba | Some scholars permit under strict conditions |

| Gold/Silver | Stricter halal rules | Must be exchanged immediately and physically where applicable | Spot trading acceptable; CFDs often problematic |

| Crypto pairs | Views diverge | Concerns over gharar, uncertainty, and intrinsic value | Some scholars approve spot crypto trading with caution |

Overall, spot FX trading with compliance features is widely accepted, while products like forward contracts and CFDs require careful scrutiny. Crypto remains a nuanced area with emerging fatwas and opinions. Traders should align product choices with their scholar’s guidance.

To help Muslim traders ensure their forex activities remain halal, here is a detailed checklist grouped by key workflow stages:

Additional steps include keeping a pre-trade checklist, reviewing broker regulatory updates, and ensuring ethical trading behaviors. Always ask brokers for written proof of Islamic compliance to avoid ambiguity. Next, we address frequently asked questions for practical clarity.

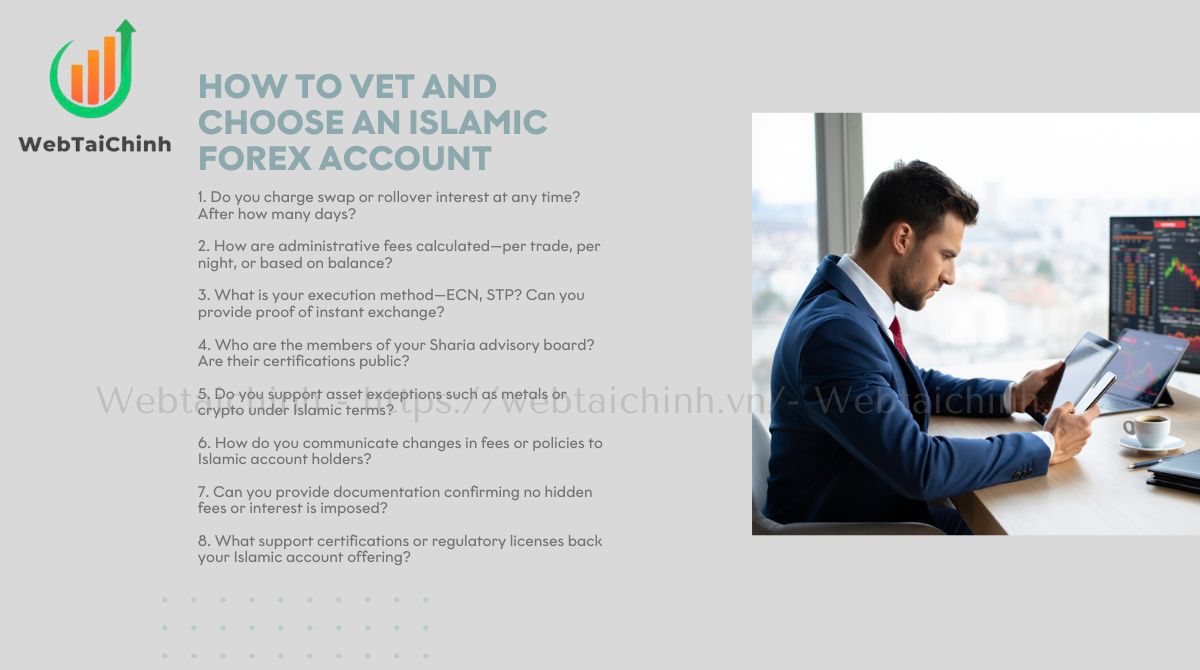

Choosing a compliant broker requires thorough questioning. Key questions to ask include:

Additional questions cover transparency, complaint escalation, and customer support responsiveness.

| Red Flags | Green Lights |

| Hidden time-linked costs not disclosed | Clear, fixed fees documented upfront |

| Vague answers about Sharia board or policy | Named Sharia scholars with credentials, dated fatwas |

| Unregistered or offshore unregulated brokers | Broker registered with recognized regulatory bodies |

| Swap charges applied despite swap-free claim | Transparent swap-free policy, no interest fees proven |

Always ask for written proof or official documentation before opening an account. Ethical broker behavior supports ongoing halal compliance.

The goal is sustainable and ethically earned profit. Uncontrolled speculation damages both portfolio and Sharia adherence.

Several Islamic institutions have studied forex trading’s permissibility, offering varying rulings. Key bodies include the Organization of Islamic Cooperation (OIC) Fiqh Academy, Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI), and multiple national mufti councils.

| Institution | Position on forex trading | Notes |

| OIC fiqh academy | Forex trading halal under strict spot, swap-free conditions | Emphasizes baiʿ al-ṣarf and riba avoidance |

| AAOIFI | Cautiously permits spot FX with Islamic accounts | Disallows forward contracts and leveraged trades with riba |

| Local Muftis (Varies) | Opinions vary; many allow spot, few permit CFDs or crypto | Context-dependent; recommends consultation |

| International Islamic Fiqh Academy | Harms speculation, warns against CFDs due to gharar | Recommends clear contracts and no-interest trading |

Consensus underscores the necessity of immediate settlement and prohibition of interest, while disagreement persists over CFDs and cryptocurrencies. Users should assess fatwa authority, recency, and jurisdictional relevance.

| Feature | Standard account | Islamic account |

| Swap/Rollover interest | Applied daily | Not charged (swap-free) |

| Admin fees | May include swap-related fees | Fixed non-interest fees only |

| Settlement time | Varies, often same day | Immediate, spot basis |

| Leverage policy | Interest-based margin common | Restricted leverage with no interest |

| Sharia oversight | None or minimal | Supervised by Sharia board |

| Exceptions handling | Flexible but often interest-charged | Strict adherence to non-riba rules |

| Documentation | Standard terms and conditions | Clear Islamic compliance policies |

| Customer support | General support | Dedicated Islamic account support |

How to interpret: Prioritize accounts with no swaps, transparent fees, proper Sharia governance, and immediate settlement to ensure halal adherence.

Read more:

Yes, trading spot FX with a swap-free account is generally accepted as halal by many scholars (see AAOIFI fatwa).

Most scholars caution against leverage that involves interest-based margin; low leverage with no interest may be acceptable.

CFDs are heavily debated; many classify them as haram due to gharar and synthetic nature, but some allow under strict conditions.

Gold and silver spot trading is permissible with immediate exchange; crypto opinions diverge, with some scholars accepting spot trading cautiously.

If done without swap/interest fees and speculation is managed responsibly, day trading can be halal.

They can be, so transparency and fixed fee structure are essential.

Only on swap-free accounts with no interest charges; otherwise, it is problematic.

Official swap-free policies, Sharia board oversight, and transparent fee disclosures define an Islamic broker.

So, is forex trading halal or haram? The answer depends on strict adherence to Islamic principles. Forex can be halal when traders use swap-free accounts, focus on spot FX with immediate settlement, and avoid speculation, riba, and gharar.

However, practices like interest-based margin, overnight swaps, and unclear contracts push forex into haram territory. By following a compliance checklist and seeking guidance from qualified scholars, Muslim traders can participate ethically in the forex market.

Web Tai Chinh is your trusted source for clear financial insights, helping you make informed and faith-aligned investment decisions.

Web Tai Chinh is a portal that updates news and information related to finance quickly and accurately, helping users have an overview before investing, clearly understanding concepts and terms related to Finance. Explore more insights in our Forex category, start your FX trading journey today with the right partner for long-term success.

📞 Contact: 055 937 9204

✉️ Email: webtaichinhvnvn@gmail.com

📍 Address: 13 Ho Tung Mau, An Binh, Di An, Binh Duong