Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Have you ever wondered is the Iraqi Dinar on the forex and why it attracts so much attention from traders and investors worldwide? Despite being frequently mentioned in forums and news sites, the Iraqi Dinar remains a unique case in the global currency market.

Unlike major pairs such as EUR/USD or GBP/USD, its trading availability, liquidity, and exchange rate regime differ significantly. Understanding these distinctions is essential for anyone curious about IQD’s real role in the forex world.

No, the Iraqi Dinar is not broadly available for trading on global retail forex platforms in 2025. Unlike major currency pairs such as EUR/USD or USD/JPY, the IQD remains under a managed exchange rate system, subject to capital controls and restricted broker participation.

This distinction highlights why IQD’s presence on forex differs greatly from freely floating, highly liquid currencies widely accessible on retail brokerages.

Being “on forex” generally refers to a currency’s accessibility and activity level in the foreign exchange market, especially concerning retail traders. It combines several factors including liquidity, broker availability, and a freely floating exchange rate, meaning market forces largely dictate the currency value.

For clarity, it’s important to distinguish between visibility and tradability. A currency may be quoted on data aggregators or financial news sites but still be non-tradable on retail platforms due to regulatory or liquidity constraints.

| Attribute | IQD | Major FX Pair (e.g., EUR/USD) | Emerging Market FX (e.g., USD/TRY) |

| Exchange Rate Regime | Managed/Controlled | Freely Floating | Freely or Partially Floating |

| Tradability | Limited/Restricted | Widely Tradable | Moderate Liquidity |

| Typical spread | Wide (>100 pips) | Low (1-3 pips) | Medium |

| Broker access | Rare/None | Universal | Selective |

| Liquidity | Low | High | Moderate |

This table demonstrates how IQD’s managed regime and liquidity considerations fundamentally limit its forex market presence. Broker compliance requirements and liquidity provision infrastructures favor established, freely floating currencies.

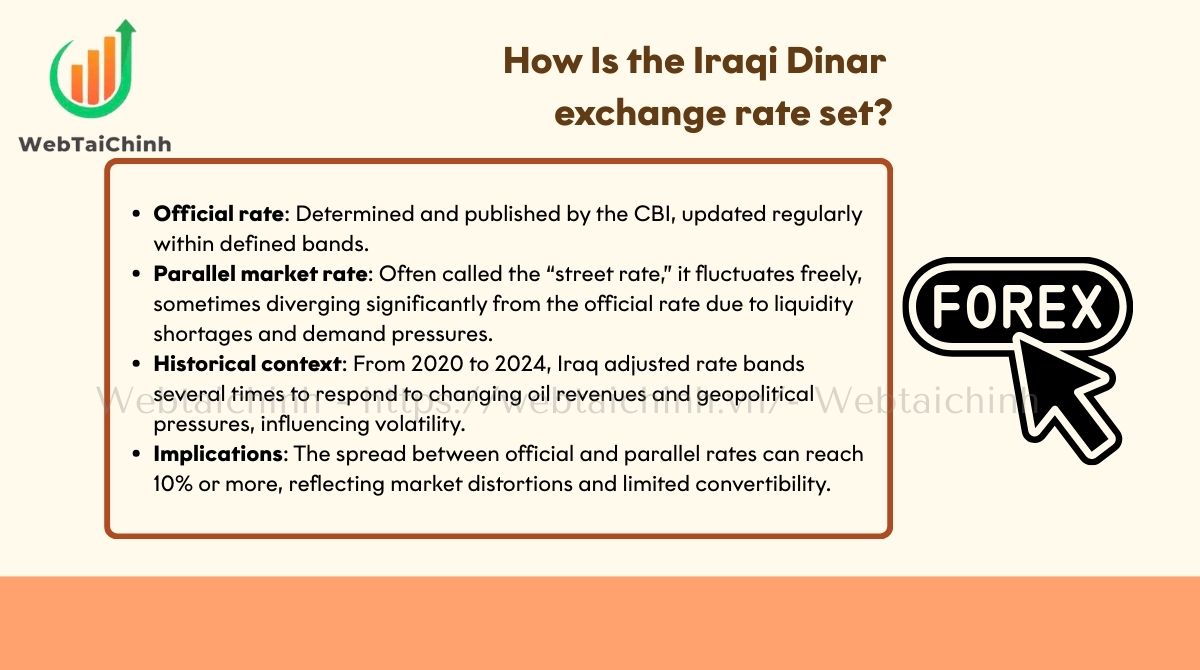

The Central Bank of Iraq manages the Iraqi Dinar with a fixed or banded exchange rate system. The CBI sets official rates and employs policy instruments such as foreign currency reserves management and capital controls to maintain stability. This approach contrasts with fully floating currencies where price discovery happens organically based on market demand and supply.

Read more: What is a forex margin? Definition, examples & formulas

Understanding these dual rate systems is essential when assessing IQD’s forex accessibility and realistic pricing.

IQD trading availability is extremely limited. Major retail forex brokers do not offer IQD pairs due to regulatory complexities, settlement challenges (see also what is considered the greatest risk associated with forex settlement), liquidity scarcity, and anti-money laundering (AML) concerns.

Before engaging in any IQD transaction, thorough due diligence and verification of broker legitimacy and compliance standards are crucial to avoid financial loss.

Accurate and timely rate information is vital for anyone interested in IQD. Several trustworthy sources provide varying perspectives on IQD value:

| Rate source | Type | Update frequency | Reliability |

| Central Bank of Iraq (CBI) | Official | Daily/Weekly | High |

| XE.com | Aggregated market prices | Real-time | Moderate (reflects limited liquidity) |

| Bloomberg/Investing.com | Financial data aggregators | Real-time | Moderate |

| Parallel market websites | Unofficial market | Discontinuous | Low (unregulated) |

Key tips: Always check the timestamp and source of rates, and understand that live tickers rarely represent executable prices due to IQD’s low liquidity and capital controls. Official CBI communications should be your primary source for policy changes.

When exploring the question is the Iraqi Dinar on the forex, it’s important to recognize the practical risks and realities surrounding this currency. Unlike major pairs, the IQD carries unique challenges tied to policy controls, limited liquidity, and economic dependence on oil revenues. Traders and investors must be cautious, as these factors create an environment very different from traditional forex markets.

These factors underscore why IQD trading diverges significantly from major forex pairs and why financial prudence is essential.

Read more:

No, MetaTrader and most mainstream retail platforms do not offer IQD currency pairs due to regulatory and liquidity reasons.

The official rate fluctuates within bands set by the Central Bank of Iraq; updated rates are available on the CBI website and trusted financial aggregators.

Due to limited official supply, regulations, and liquidity shortages, the parallel market reflects more volatile demand-based pricing.

While possible in theory, such an event requires significant policy changes, economic reforms, and international conditions. Rumors often lack credible backing.

Yes, but cross-border trading may face restrictions depending on jurisdiction and broker policies.

No, there are currently no mainstream ETFs or CFD products tracked directly to IQD due to its restricted nature.

Beware of unsolicited offers promising large returns or guaranteed “revaluations,” and always verify sources and regulatory status.

Most investors are local businesses or institutions connected to Iraq’s economy; retail speculation often drives demand outside these groups.

In summary, the question is the Iraqi Dinar on the forex reveals more complexity than a simple yes or no. While it may appear on rate tickers and financial data sites, actual tradability on global forex platforms remains extremely limited.

For traders and investors, the IQD highlights the importance of understanding liquidity, policy, and risk before making decisions. To stay updated with reliable insights and practical guides on forex and global markets, visit webtaichinh.

Web Tai Chinh is a portal that updates news and information related to finance quickly and accurately, helping users have an overview before investing, clearly understanding concepts and terms related to Finance. Explore more insights in our Forex category, start your FX trading journey today with the right partner for long-term success.

📞 Contact: 055 937 9204

✉️ Email: webtaichinhvnvn@gmail.com

📍 Address: 13 Ho Tung Mau, An Binh, Di An, Binh Duong