Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Volume meaning in crypto refers to the total number of coins or tokens traded over a specific period, often 24 hours. It’s a crucial metric that helps investors and traders assess market activity, liquidity, and potential price movements. Understanding volume in crypto can provide valuable insights into market trends, investor sentiment, and the overall health of a digital asset.

Trading volume in cryptocurrency refers to the total number of coins or tokens exchanged, bought and sold, over a specific period, most commonly 24 hours. Think of it like counting the number of customers in a busy supermarket; the more people passing through, the livelier the store feels. For crypto markets, volume reveals where the action is happening, it shows which coins are in demand and signals activity that pure price charts may not reveal.

Understanding volume is essential for anyone looking to read crypto market dynamics, assess trends, and make better trading or investing decisions. In this guide, you’ll learn what trading volume means, why it matters, and how to use it effectively in your 2025 crypto journey.

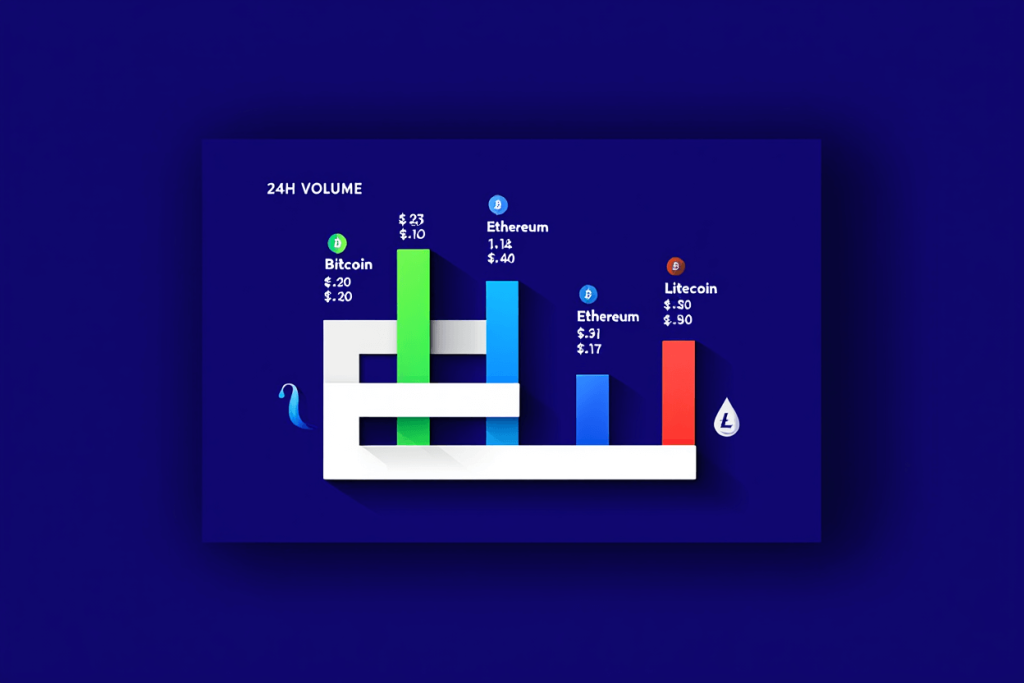

In the world of crypto, volume measures the total quantity of a digital asset bought and sold within a specific period, most often over 24 hours. This figure includes every completed trade, whether the asset was purchased or sold. Crypto volume can be displayed in the number of tokens or coins (for example, 50,000 ETH exchanged) or in monetary terms (like $120 million worth of Bitcoin traded). Platforms sum up all executed trades during a chosen window to arrive at this figure. High 24-hour volume typically points to an active, liquid market, whereas low volume may signal inactivity and risk.

| Coin | Volume (24h) | Value in USD |

|---|---|---|

| Bitcoin (BTC) | 320,000 | $22,400,000,000 |

| Ethereum (ETH) | 1,250,000 | $4,700,000,000 |

| Litecoin (LTC) | 750,000 | $85,000,000 |

To explore similar concepts, check our crypto knowledge section for beginner-friendly explanations.

Volume isn’t just a statistic, it’s a direct signal of what’s happening in crypto markets right now. Understanding trading volume helps you see which digital assets are truly in play, guides smarter investing, and can keep you safer from market pitfalls.

For instance, during 2024’s Bitcoin ETF approval spike, volumes soared, reinforcing trust and providing confirmation to many traders. Meanwhile, coins with volume below $100,000 a day often lack genuine market interest and can suffer wild price swings.

Volume data is everywhere on crypto exchanges and market tracking tools, but its real value comes from knowing what it means for your trades or investments. Let’s break down how high and low volumes affect your decisions, plus how to spot crucial patterns.

High-volume coins (like Bitcoin during a major news event) usually have deep order books, tighter spreads (smaller price gaps between buy and sell orders), and faster trade execution. This creates a healthier market, where prices are less likely to spike or crash unexpectedly. Sustained high volume, especially when paired with a trend (up or down), can confirm genuine market interest.

Low-volume assets can be risky. Thin trading means prices can jump (or fall) sharply on even small orders, often making these coins targets for pump-and-dump operations. Plus, selling or buying large amounts without moving the price dramatically can be difficult.

| Day | Price (ETH) | Volume (ETH) |

|---|---|---|

| Mon | $3,500 | 800,000 |

| Tue | $3,480 | 750,000 |

| Wed | $3,600 | 1,200,000 |

| Thu | $3,550 | 1,000,000 |

| Fri | $3,620 | 1,350,000 |

Notice how volume spikes on Wednesday and Friday match major price moves, a common pattern when important news drops or market sentiment shifts.

A classic pump and dump would display a rapid volume increase followed by a quick drop, with price manipulation in between. Learning these signals is vital for any crypto market participant.

See more related articles:

Not all volume is created equal. In the diverse world of crypto, several distinct types of trading volume exist, each revealing a different aspect of market activity and reliability.

| Coin | Spot Volume (24h) | Futures Volume (24h) |

|---|---|---|

| BTC | $20B | $50B |

| ETH | $5B | $19B |

Controversies over fake volume remain a hot topic, as accurate data is crucial for fair trading, particularly in the age of DeFi and rapidly evolving crypto trends in 2025.

See more related articles:

Understanding volume is one thing, using it is another. Here are real-life scenarios and a quick guide to help you apply these concepts:

| Exchange | BTC Volume (24h) | ETH Volume (24h) |

|---|---|---|

| Binance | $12B | $4.2B |

| Coinbase | $3.5B | $1.1B |

Always verify volume across more than one source for a clearer, more trustworthy picture of market health.

Crypto trading volume doesn’t move randomly. Several key factors can send it soaring or cause it to dwindle, often in response to news, technical updates, or market mood swings.

For example, Dogecoin’s 2021 TikTok-fueled rally or Bitcoin’s periodic volume spikes around halving events show just how much outside factors impact crypto volume.

Below are Popular Ways Traders Use Volume Data in Crypto Strategies:

If you’re just getting started, start with the first five strategies, they cover the essentials. Over time, adding the rest to your trading toolkit can provide major advantages in increasingly sophisticated crypto markets.

| Metric | Definition | When to Care |

|---|---|---|

| Volume | Total trading activity over a period | Evaluating market energy, participation, and trends |

| Liquidity | How easily an asset can be bought/sold without affecting its price | Ensuring quick, efficient entries/exists in any market |

| Volatility | How rapidly and widely price moves | Assessing risk; choosing stable vs. fast-moving trades |

While these terms are related, they aren’t interchangeable. Confusing them can lead to costly mistakes, such as entering a market with high volume but low liquidity (difficult to exit) or high volatility with low volume (increased manipulation risk). Use each metric in its proper context for smarter decisions.

Whether you’re trading Bitcoin, Ethereum, DeFi tokens, or NFTs, understanding trading volume is crucial, not just within crypto, but also in broader markets like stocks, commodities, and forex. Mastering volume analysis opens the door to more confident, informed investing. To deepen your expertise, explore related financial metrics such as liquidity, volatility, and order book depth, and keep building your financial literacy as markets evolve in 2025 and beyond.

Trading volume is more than just a number, it’s the heartbeat of the crypto market. It reveals activity, signals trust, highlights risks, and guides smarter trades. By understanding and interpreting volume in its many forms, you gain an analytical edge in evaluating crypto trends, assessing new projects, and navigating the volatility and opportunity that define digital assets. Whether you’re a seasoned trader or new to cryptocurrency, routinely tracking and analyzing volume will sharpen your strategies and help you make better investment decisions in a fast-changing landscape.

Web Tai Chinh is your trusted portal for staying up to date with the latest in finance, offering fast and reliable news, detailed guides, and clear explanations of core investment concepts. Empower yourself with clear, up-to-date financial knowledge before making any investment decisions, and confidently master the evolving finance landscape with every visit to our site.

📞 Contact: 055 937 9204

✉️ Email: webtaichinh@gmail.com

📍 Address: 13 Ho Tung Mau, An Binh, Di An, Binh Duong