Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

If you’re new to currency trading, one of the first questions you may ask is what is a spread only account in forex. This type of account offers traders a simplified cost structure where all fees are included in the spread between bid and ask prices. By eliminating separate commissions, spread-only accounts make it easier for beginners and casual traders to understand their trading costs upfront.

Key takeaways:

A spread-only forex account is a type of trading account where the broker’s fee is embedded solely within the spread of the difference between the bid and ask prices without charging any additional commission per trade. This account type exists primarily to simplify cost structures by bundling fees into the spread, making upfront trading costs transparent and predictable.

It appeals mainly to beginners, casual traders, and those seeking straightforward pricing without complex additional fees. Traders who prioritize simplicity and ease of understanding often prefer spread-only accounts, as the total cost is reflected directly in the market price, much like shopping where the price tag already includes all taxes and fees.

To fully grasp spread-only forex accounts, it’s vital first to understand key terms:

For example, if EUR/USD has a bid price of 1.1000 and an ask price of 1.1002, the spread is 2 pips. The cost of trading one standard lot with a 2-pip spread equates to 2 pips × $10 (pip value for standard lot) = $20 spread cost per trade.

Spread measurements rely on ticks or price increments. Leverage and margin amplify these costs because a smaller capital outlay controls a larger trading position, so spread expenses affect leveraged gains or losses proportionally. Understanding these fundamentals lays the groundwork for analyzing how spread-only accounts structure fees and impact overall trading expenses.

Spread measurements rely on ticks or price increments. Leverage and margin amplify these costs because a smaller capital outlay controls a larger trading position, so spread expenses affect leveraged gains or losses proportionally. Understanding these fundamentals lays the groundwork for analyzing how spread-only accounts structure fees and impact overall trading expenses.

As you get more comfortable with spreads and trading costs, it’s also important to think about position management and holding strategies. For instance, many traders wonder can you hold futures overnight, since carrying trades across sessions can involve additional risks and costs beyond the spread itself.

In a spread-only forex account, brokers advertise “no commission,” meaning traders pay no separate fees beyond the spread. Instead, trading costs are implicitly included in the bid-ask spread. Brokers typically source prices from liquidity providers like banks and hedge funds, then add a markup to the raw spread to cover operational costs and profit margins.

Claims of “zero spreads” usually mean the broker offers extremely tight spreads during high liquidity periods but often widen spreads during volatile times. It’s essential to understand these offers are promotional and may come with conditions such as limited trading hours or minimum deposit requirements.

Typical spread ranges differ by currency pair category:

| Currency pair type | Typical spread (pips) |

| Major Pairs (e.g., EUR/USD, USD/JPY) | 0.8 – 1.5 |

| Minor Pairs (e.g., EUR/AUD, GBP/JPY) | 1.5 – 3.0 |

| Exotic Pairs (e.g., USD/TRY, EUR/ZAR) | 3.0 – 10+ |

Understanding these ranges helps traders anticipate costs based on instrument choice and market conditions, bridging basic concepts into practical broker applications.

| Feature | Spread-only account | Raw/ECN account |

| Spread | Wider spreads (e.g., 1.2–1.5 pips) | Narrower spreads (e.g., 0.1–0.3 pips) |

| Commission | No separate commission | Fixed commission per lot (e.g., $7 per standard lot) |

| Total Cost for 1 Trade (EUR/USD) | $12 (1.2 pips × $10 pip value) | $9 (0.2 pip × $10 + $7 commission) |

| Fill Quality & Execution | Variable; possibly larger spreads/slippage in volatile markets | Usually superior due to ECN/STP with lower latency |

| Minimum Deposit | Often low or no minimum | May require higher deposits |

| Suitable For | Beginners, low frequency traders, simplicity seekers | High-frequency traders, scalpers, EA users |

Cost analysis shows raw accounts perform better as trade frequency increases, especially past 10-20 trades. Meanwhile, spread-only accounts are advantageous for traders desiring predictable upfront pricing without per-trade commissions. Trade-off considerations include execution speed, slippage, and ease of use—critical for matching account types to trading styles.

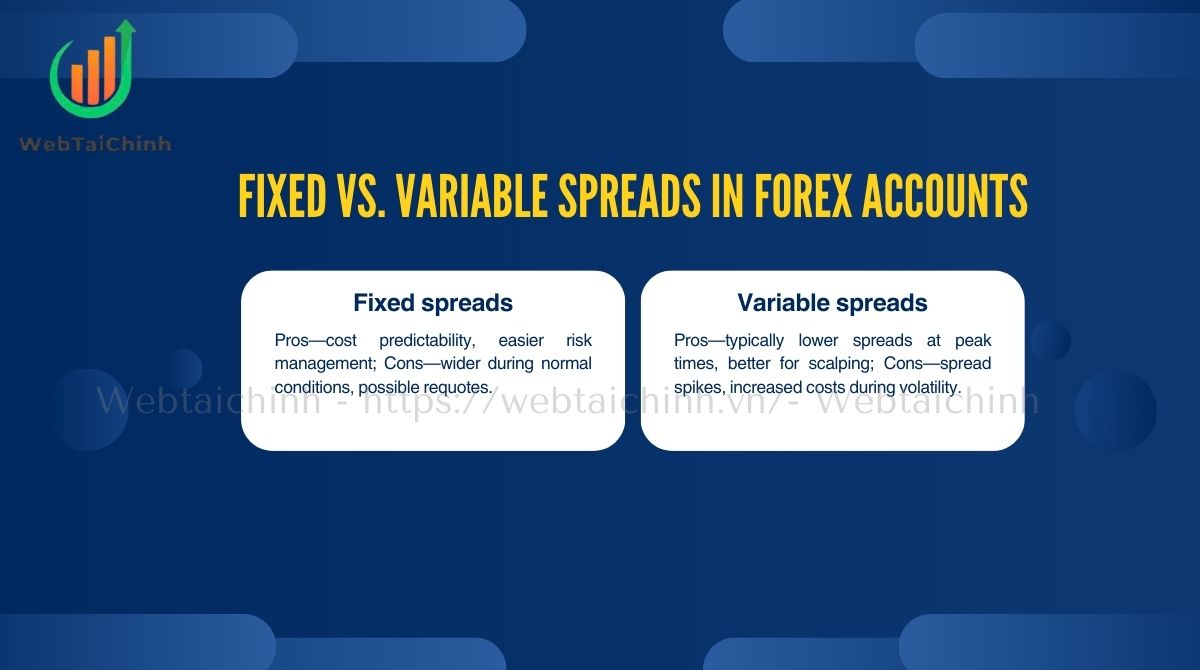

Fixed spreads remain constant regardless of market volatility, offering predictability and stable costs. Brokers usually provide fixed spreads by absorbing volatility risk themselves, which can lead to wider spreads during calm market conditions. Variable spreads fluctuate in real-time based on liquidity and market events, often narrowing during high liquidity but widening sharply during news releases or off-market hours.

Advantages and disadvantages include:

| Situation | Fixed spread | Variable spread |

| Regular Market Hours | Stable (e.g., 1.5 pips) | Narrow (e.g., 0.8 pips) |

| High-Volatility News | Same (risk broker requotes) | Spike (up to 5+ pips) |

| Off-Market Trading | Stable | Wider or unavailable |

Traders focusing on news strategies might prefer fixed spreads despite the occasional requote risk, while swing traders could benefit from variable spreads in calm markets but must be cautious during announcements.

Consider EUR/USD with a spread-only account charging 1.2 pips and a raw/ECN account charging 0.2 pips plus $7 commission per standard lot. The trading cost calculation for 1 standard lot (100,000 units) is:

Scaling costs:

For mini (10,000 units) or micro lots (1,000 units), costs reduce proportionally. For example, 1 mini lot at 1.2 pips = $1.20 spread cost.

This illustrates break-even points where raw accounts become more cost-effective as trading volume increases. Small, infrequent traders may favor spread-only accounts for simplicity despite slightly higher per-trade costs.

Spread-only accounts suit you if:

However, consider a raw/ECN account if you: Scalping involves high-frequency trades, need tight spreads and low per-trade fees, trade during volatile news periods, or utilize automated trading strategies (EAs) that require best execution and low latency.

Awareness of these risks helps traders practice caution and do thorough research before committing to spread-only accounts.

Use this universal formula:

Total Trading Cost = Spread (in pips) × Pip Value × Number of Lots

For example, trading 2 standard lots on EUR/USD with a 1.2-pip spread:

1.2 pips × $10 (pip value) × 2 lots = $24 per trade cost.

Adjust pip value for smaller lot sizes: mini lot (0.1 standard) = $1 per pip, micro lot (0.01 standard) = $0.10 per pip.

Keep in mind spread variability and occasional slippage may increase actual costs beyond calculations. Tracking average spreads over time improves realistic cost estimation.

Read more:

A spread-only forex account is one where the broker’s fee is included entirely in the spread, with no additional commission per trade.

A spread-only account has wider spreads with no commissions, while a raw pricing account offers tighter spreads but charges a fixed commission per lot.

In a spread account, costs are built into the spread. In a commission account, spreads are lower but traders pay a separate commission on each trade.

A spread account is another term for an account where the broker’s charges are included in the spread, making fees more transparent and easier to calculate.

To sum up, understanding what is a spread only account in forex helps traders choose the right setup for their style and budget. While these accounts offer simplicity and transparent pricing, it’s important to compare them with alternatives like raw/ECN accounts to see what truly fits your needs. For more in-depth insights, guides, and practical trading knowledge, visit webtaichinh.

Web Tai Chinh is a portal that updates news and information related to finance quickly and accurately, helping users have an overview before investing, clearly understanding concepts and terms related to Finance. Explore more insights in our Forex category, start your FX trading journey today with the right partner for long-term success.

📞 Contact: 055 937 9204

✉️ Email: webtaichinhvnvn@gmail.com

📍 Address: 13 Ho Tung Mau, An Binh, Di An, Binh Duong