Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

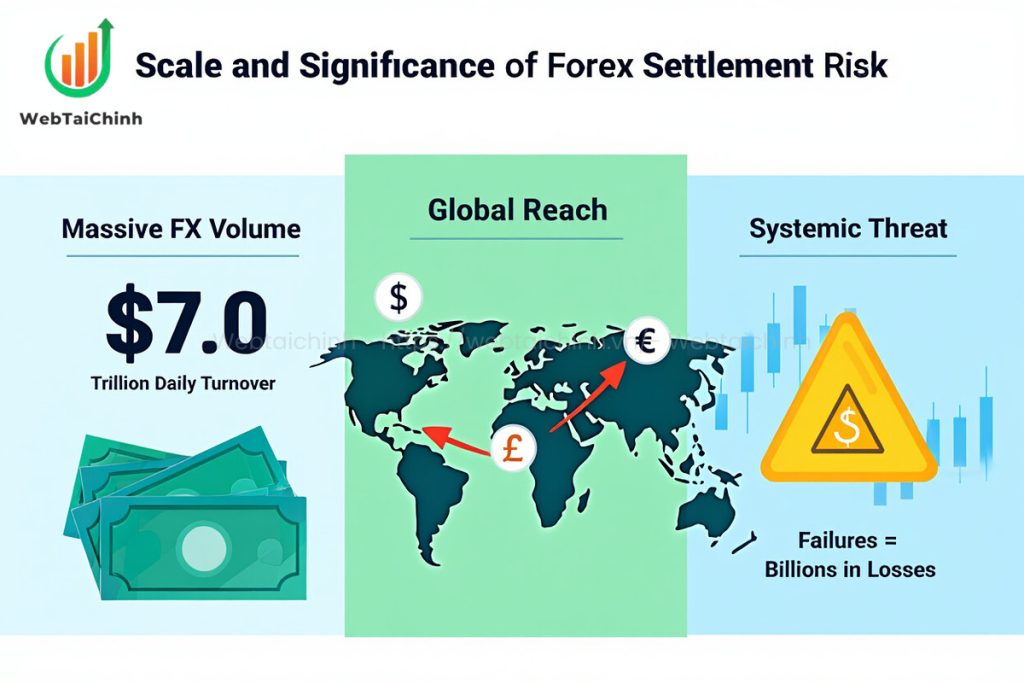

What is considered the greatest risk associated with forex settlement? It is the threat that can wipe out both sides of a trade in seconds settlement risk, also known as Herstatt risk. In the $7-trillion-a-day forex market, a single counterparty default or payment delay can cause total loss of principal and trigger systemic shocks.

In this guide, you’ll learn why this risk is regarded as the most dangerous in forex settlements, how it happens, and the proven methods professionals use to mitigate it.

Key takeaways:

Let’s explore the data, real-world cases, and solutions together with Webtaichinh to help you protect your trades and avoid costly mistakes.

Forex settlement is the process that finalizes a currency trade, ensuring each party delivers the agreed currency to the other. But what is considered the greatest risk associated with forex settlement? It is settlement risk, also called Herstatt risk the danger of losing the full value of a transaction if the counterparty fails to deliver their side of the deal on time or at all.

In the world’s largest financial market, with daily volumes exceeding $7 trillion, this is not a rare or minor threat. The consequences can be catastrophic, leading to immediate principal losses and even systemic disruptions across global markets. This introduction will give you a clear view of what settlement risk means, why it holds the top position among FX settlement threats, and set the stage for exploring its scale, mechanics, and modern mitigation strategies in the sections ahead.

Settlement risk refers to the possibility that one party delivers the currency it sold but does not receive the currency it bought. The problem often arises because of time zone differences, mismatched banking hours, or counterparty failure. For example, if a bank in New York sends USD to a counterparty in Tokyo in the morning, but the Tokyo bank fails before sending JPY in return, the New York bank loses its entire transferred amount.

This type of risk is different from partial payment delays or market volatility it puts the full principal amount at stake for both parties simultaneously.

Among all FX-related risks, settlement risk stands out because:

Dual exposure: Both currencies in the trade are at risk, not just one side.

Systemic potential: A single default can cascade through interconnected financial institutions.

Magnitude: With trillions at stake daily, even small failures can translate into billions in losses.

Regulatory bodies like the BIS, the Federal Reserve, and the ECB consistently rank settlement risk as the most critical challenge in maintaining stability in global FX markets.

Settlement risk is not a niche concern it is a systemic threat amplified by the massive scale of the global FX market. According to the Bank for International Settlements (BIS) Triennial Survey 2024, average daily FX turnover exceeds $7.0 trillion, with settlements occurring across multiple time zones and involving thousands of counterparties. This vast volume means that even short-lived settlement failures can create losses in the billions.

The BIS estimates that in 2025, over $2.2 trillion in currency transactions remain exposed to settlement risk daily despite improvements like Payment-versus-Payment (PvP) systems. Not all currency pairs, especially exotic or emerging market pairs, are covered by PvP frameworks such as Continuous Linked Settlement (CLS).

learn more same: PvP crypto meaning ?

A quick breakdown of estimated daily settlement exposure by region (2025 data):

| Region | Daily Settlement Exposure (USD Trillions) | Share of Global Exposure |

|---|---|---|

| North America | 0.9 | 40.9% |

| Europe | 0.8 | 36.4% |

| Asia-Pacific | 0.5 | 22.7% |

This means that more than 30% of daily FX trades globally remain outside PvP protection, leaving significant room for operational and counterparty failures to trigger losses.

The 1974 collapse of Bankhaus Herstatt is the most famous case, but not the only one. More recent disruptions including emerging market currency settlements delayed during geopolitical tensions in the early 2020s have shown how fragile the system can be when payment networks are stressed.

The lesson is clear: the combination of huge transaction volumes and partial risk coverage means settlement risk continues to be the greatest threat associated with forex settlement, both for individual institutions and the market as a whole.

In the hierarchy of foreign exchange risks, what is considered the greatest risk associated with forex settlement is settlement risk and for good reason. While market risk, liquidity risk, and operational risk are all important, none pose the same dual-principal threat or systemic danger.

Liquidity risk

This occurs when a trader or institution cannot access enough funds to meet settlement obligations on time without incurring significant costs. While it can disrupt operations, liquidity risk typically affects only one side of a trade and does not automatically cause full principal loss.

Market risk

This is the danger of currency price fluctuations between trade execution and settlement. While market risk can erode profitability, it is often mitigated with hedging tools. Unlike settlement risk, it does not involve both currency amounts being at risk simultaneously.

Operational risk

Failures in internal processes, systems, or human errors can delay settlements. While serious, these issues are often correctable if both parties remain solvent and cooperative.

Settlement risk is unique because it exposes the entire notional value of both currencies in a transaction. If one party delivers their currency but the other fails due to insolvency, regulatory intervention, or operational breakdown the delivering party loses the entire amount with no guaranteed recovery.

| Risk Type | Description | Potential Loss Scope | Systemic Impact | Greatest Risk? |

|---|---|---|---|---|

| Settlement risk | Loss of both currencies if counterparty fails to deliver | Full principal on both sides | High (cascading defaults) | Yes |

| Liquidity risk | Inability to access funds for settlement | Partial or delayed amounts | Medium | No |

| Market risk | Losses from currency price changes | Varies with exposure | Low–Medium | No |

| Operational risk | Failures in processes or systems | Limited if solvency remains | Low | No |

Key insight: Settlement risk is not just a “bigger” risk it is categorically different because it combines high loss potential with systemic reach.

Even with modern payment systems, what is considered the greatest risk associated with forex settlement can emerge from something as basic as timing mismatches or counterparty failure. Understanding how settlement risk materializes helps traders and institutions design better safeguards.

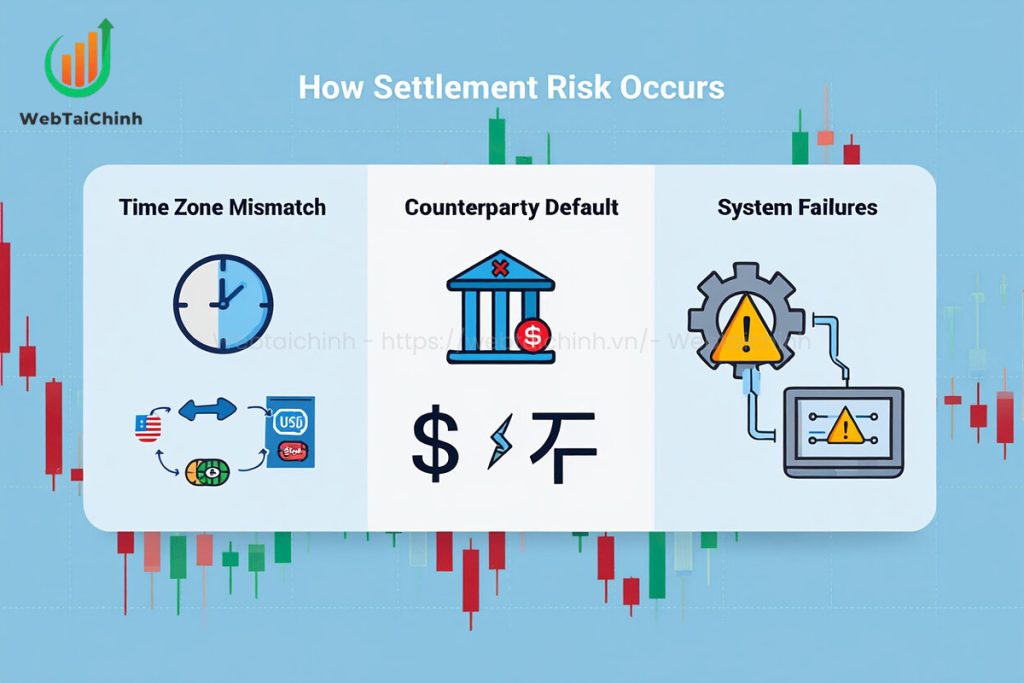

The global FX market operates 24 hours a day, but payment systems follow local banking hours. This creates inevitable “time gaps” between when one party sends funds and when the other can confirm receipt.

Example:

A U.S. bank sends USD to a Tokyo-based counterparty at 9:00 AM New York time.

Due to the time difference, Tokyo banking hours may have already ended.

The Japanese counterparty can only send JPY the next business day.

If the Tokyo bank defaults overnight, the U.S. bank loses the USD it already sent.

This asynchronous process is where most settlement risk resides the window of vulnerability between currency deliveries.

Settlement risk can also occur when:

Counterparty insolvency: The receiving institution collapses before delivering its leg of the trade (e.g., Bankhaus Herstatt in 1974).

Regulatory intervention: Authorities freeze a bank’s operations, halting outgoing payments.

Operational disruption: Payment networks suffer outages or cyberattacks that delay transfers.

Unlike market volatility or liquidity crunches, these events can instantly transform a standard trade into a total loss scenario.

Pro tip: This is why major institutions use Payment-versus-Payment (PvP) systems wherever possible to ensure both currencies are exchanged simultaneously, closing the window for settlement risk.

Although what is considered the greatest risk associated with forex settlement can never be fully eliminated, several proven strategies and systems significantly reduce exposure. The most effective methods combine technology, contractual agreements, and regulatory oversight.

Definition: PvP ensures that the final transfer of one currency occurs if, and only if, the other currency is delivered. This simultaneous exchange closes the window of vulnerability.

Example – Continuous Linked Settlement (CLS):

CLS is the largest PvP platform, covering 18 major currencies.

It settles transactions by linking payment instructions across central banks, ensuring both legs are exchanged simultaneously.

According to CLS 2025 reports, it processes over $6 trillion daily.

Limitations:

Not all currency pairs are covered especially exotic or emerging market currencies.

Requires both counterparties to be CLS participants or connected via member banks.

Bilateral netting: Two parties agree to offset mutual obligations, paying only the net amount due.

Multilateral netting: Multiple participants consolidate settlements into a single net payment through a central clearinghouse.

Benefits:

Reduces the gross value at risk.

Cuts transaction costs.

Drawbacks:

Does not fully remove settlement risk only lowers the exposure amount.

FX Global Code:

A voluntary set of principles endorsed by the BIS, central banks, and major market participants.

Encourages transparency, operational resilience, and prioritization of PvP settlement when available.

Central bank initiatives:

The Federal Reserve, ECB, and Bank of England conduct periodic stress tests to identify systemic vulnerabilities.

Guidance documents recommend mandatory PvP use for eligible currencies.

Practical steps for institutions:

Regular monitoring of counterparty creditworthiness.

Using real-time gross settlement (RTGS) systems for high-value transfers.

Implementing contingency plans for operational disruptions.

Key insight: Mitigation is a layered process. Relying on a single tool like PvP or netting is insufficient; combining technical solutions with strong governance yields the best protection.

Even with advanced systems like CLS and widespread adoption of best practices, what is considered the greatest risk associated with forex settlement remains a live concern. Certain structural and market factors leave critical gaps in protection.

Emerging market currencies: Many currencies in Africa, Latin America, and parts of Asia are not supported by major PvP platforms.

Exotic currency pairs: Thinly traded pairs often rely on manual settlement arrangements, increasing exposure.

Partial participation: Some counterparties may not have access to PvP systems due to membership costs or infrastructure limitations.

These gaps mean that a significant share of daily settlement volume over 30% globally remains exposed to full principal loss.

Operational failures: Power outages, cyberattacks, or software errors in payment networks can cause delayed or failed settlements.

Legal barriers: Cross-border differences in bankruptcy laws can hinder recovery when a counterparty fails.

Fragmented infrastructure: Not all countries use interoperable payment systems, making real-time coordination difficult.

Blockchain-based settlement: Distributed ledger technology (DLT) can enable atomic swaps where both sides of a trade settle instantly without intermediaries. However, regulatory acceptance and scalability remain hurdles.

ISO 20022 adoption: This global payment messaging standard allows richer data exchange, improving transparency and error detection.

Instant payment systems: Some jurisdictions are piloting cross-border instant settlement platforms that could reduce time-zone-related risk windows.

Forward-looking insight: While new technologies show promise, history suggests that adoption will be gradual. For now, the combination of PvP where available, robust operational controls, and vigilant counterparty monitoring remains the most practical defense.

Broaden your understanding with these reads:

It is settlement risk, also known as Herstatt risk the danger that one party delivers its currency but does not receive the counter-currency, putting the full principal at stake for both sides.

Because it can cause the total loss of both currency amounts in a single trade and has the potential to trigger systemic failures across interconnected markets.

No. While Payment-versus-Payment (PvP) systems like CLS can greatly reduce it, gaps remain for unsupported currencies, exotic pairs, and non-PvP counterparties.

Typically, emerging market and exotic currencies, due to limited PvP coverage and less integrated payment systems.

What is considered the greatest risk associated with forex settlement is settlement risk a threat capable of wiping out both sides of a trade and destabilizing entire markets. In the $7-trillion-a-day FX ecosystem, even short-lived failures can translate into billions in losses.

This article has explored its definition, scale, how it occurs, historical examples, and modern mitigation strategies like PvP and netting. While complete elimination is impossible, layered defenses combining technology, regulation, and risk governance can greatly reduce exposure.

Checklist of key points:

How do you think new technologies like blockchain could change the way forex settlement risk is managed in the next decade? Share your thoughts or questions in the comments our team at Webtaichinh is ready to discuss.

Web Tai Chinh is a portal that updates news and information related to finance quickly and accurately, helping users have an overview before investing, clearly understanding concepts and terms related to Finance. Explore more insights in our Forex category, start your FX trading journey today with the right partner for long-term success.

📞 Contact: 055 937 9204

✉️ Email: webtaichinhvnvn@gmail.com

📍 Address: 13 Ho Tung Mau, An Binh, Di An, Binh Duong