Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

In forex trading, one of the most important concepts every trader must understand is what is margin level in forex. This metric is more than just a number on your trading platform; it is the key to knowing whether your account is healthy, whether you can open new positions, or if you are at risk of a margin call. By mastering the idea of margin level, traders gain the ability to balance opportunity with risk, protect their capital, and trade with confidence.

Key takeaways:

Margin level in forex trading is a crucial metric that represents the ratio between a trader’s equity and the used margin, expressed as a percentage. It indicates how much of a trader’s funds are available to maintain open positions and helps both traders and brokers assess account health and risk exposure. The formula to calculate margin level is:

Margin Level = (Equity / Used Margin) × 100

For example, if a trader’s equity is $3,000 and the used margin is $1,000, the margin level will be 300%. Margin level plays a vital role in controlling trading risks, determining whether traders can open new positions, face margin calls, or risk stop-outs.

It is monitored both before and after trades to ensure sufficient funds are maintained, protecting the trader from excessive losses and ensuring the broker’s security. Understanding margin level is fundamental for successful risk management and maintaining a healthy forex trading account.

Margin level acts as a risk gauge used by brokers to ensure traders maintain adequate funds to support their open positions. Brokers monitor margin levels continuously and have predefined thresholds that trigger specific account actions:

These levels vary by broker but generally follow similar patterns to control risk. Brokers use margin calls to alert traders when their equity nears the used margin, allowing time to add funds or close positions.

If the margin level falls below the stop-out threshold, automatic liquidation occurs, closing positions with the largest losses or highest margin requirements first. This system protects both the trader and broker from excessive losses and enforces disciplined trading practices.

Understanding margin level in forex trading requires a clear grasp of the key terms that define account health and trading capacity. Concepts like equity, used margin, free margin, and leverage are the foundation for managing risk and making informed decisions.

By breaking down these terms, traders can see how their funds are allocated, how much capital is available for new positions, and how leverage directly influences both profit potential and risk exposure.

Account equity refers to the total funds in a trading account, combining the current balance with any unrealized profit or loss from open positions. It reflects the trader’s real-time financial standing and fluctuates as market prices change. Components include:

Used margin is the amount of capital locked to maintain open positions. It depends on position size and leverage. For example, opening a $100,000 position with 1:100 leverage requires $1,000 used margin, representing the funds reserved by the broker to cover potential losses.

Free margin is the remaining equity available after accounting for used margin, calculated as:

Free Margin = Equity − Used Margin

It represents funds a trader can use to open new positions or absorb losses.

Leverage allows traders to control larger positions with a smaller amount of capital, essentially borrowing funds from the broker. While leverage reduces the margin needed per trade, it also magnifies both potential gains and risks. The impact on margin level includes:

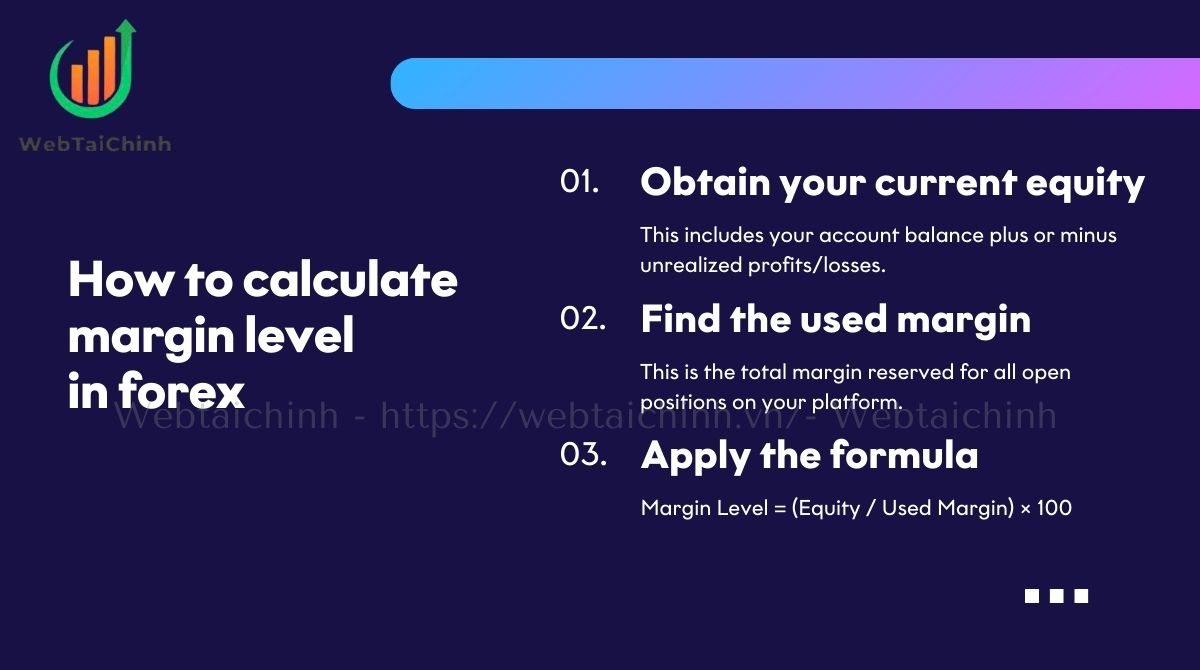

Calculating margin level is straightforward and can be done in three easy steps:

Margin Level = (Equity / Used Margin) × 100

For instance, with an equity of $3,000 and used margin of $1,000, Margin Level = ($3,000 / $1,000) × 100 = 300%. Many trading platforms feature built-in calculators or widgets to automate this process, allowing traders to monitor their margin health efficiently.

To trade safely, it’s not enough to know how to calculate margin level; you also need to understand what different threshold levels mean in practice. Margin level thresholds act as warning signals that determine whether you can open new trades, face a margin call, or risk automatic stop-outs. By interpreting these key levels correctly, traders can anticipate broker actions, protect their capital, and avoid unnecessary account liquidation.

The 100% margin rule means that when your margin level reaches 100%, your equity equals the used margin, and most brokers won’t allow opening new trades. This is a critical warning level that requires traders to either add funds or close positions to maintain account health. For example, brokers like IG and Forex.com enforce this rule strictly to manage risk.

When there are no open trades, used margin is zero, which can make your margin level display as 0%. However, this does not indicate risk or margin issues since no capital is committed. Margin level thresholds and calls apply only when used margin is above zero.

Understanding margin level becomes clearer when you look at real-life examples. By comparing different account situations ranging from safe levels with plenty of equity to critical thresholds that trigger stop-outs traders can see how equity, used margin, and margin level percentages interact in practice.

These worked examples make it easier to grasp when an account is healthy, when caution is needed, and when immediate action is required to avoid forced liquidation.

| Case | Equity ($) | Used Margin ($) | Margin Level (%) | Can Open New Trades? | Risk of Stop-Out? |

| 1. High Safe Level | 5,000 | 1,000 | 500% | Yes | No |

| 2. Near 100% Limit | 1,200 | 1,200 | 100% | No | Yes (imminent margin call) |

| 3. Approaching Stop-Out | 300 | 1,000 | 30% | No | Yes (auto liquidation likely) |

| 4. No Open Trades | 2,000 | 0 | 0% | Yes | No |

Case 1 illustrates a healthy margin level with ample equity to support trades. In Case 2, the trader reaches a limit where no new trades are allowed, signaling caution. Case 3 signals immediate risk, triggering stop-out actions. Case 4 reminds us that margin level is irrelevant without open positions. These scenarios highlight the importance of monitoring margin level to avoid forced losses and maintain trading flexibility.

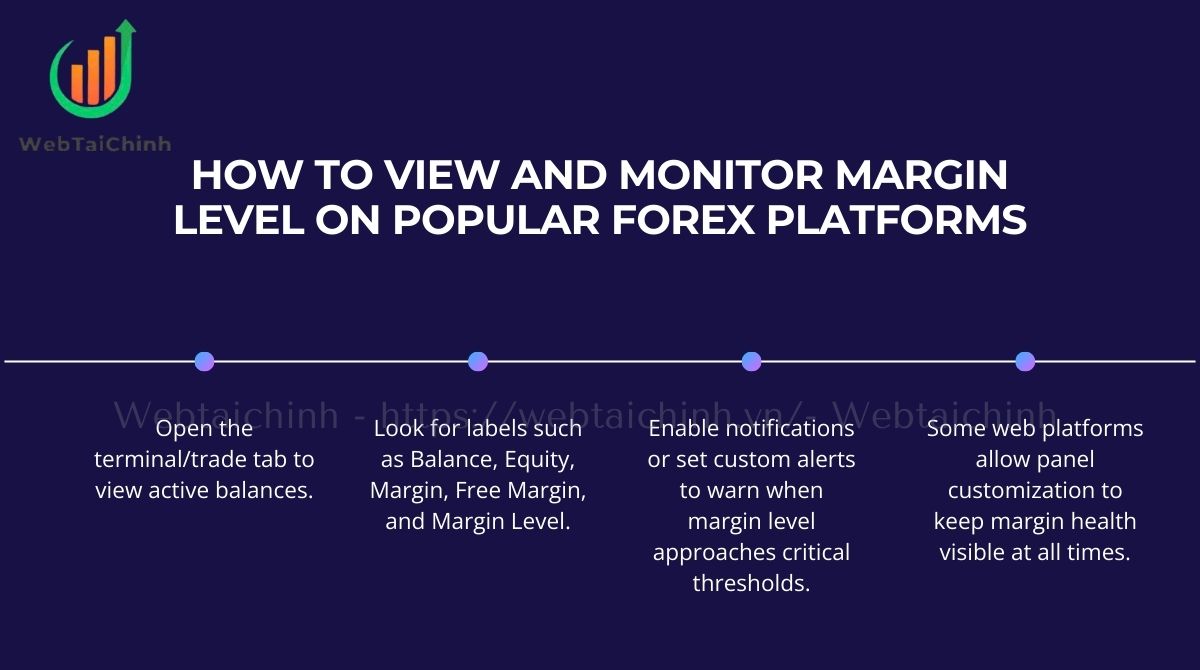

On platforms like MetaTrader 4 and MetaTrader 5, margin level is typically found in the Trade tab or terminal window, displayed as “Margin Level %.” Here’s how to monitor it:

Being proactive about margin monitoring empowers traders to manage risks and avoid margin calls effectively.

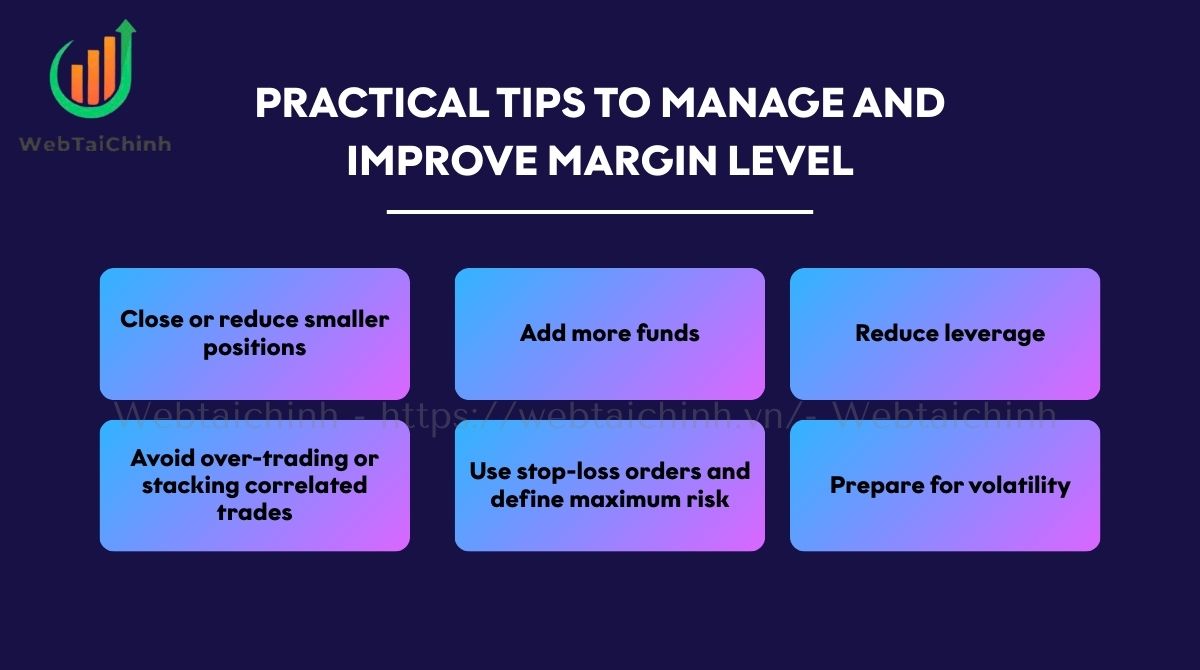

Maintaining a healthy margin level is not just about understanding the numbers, it’s about taking practical steps to protect your account. By applying smart risk management techniques, traders can prevent margin calls, avoid forced stop-outs, and keep their trading strategies sustainable.

The following tips highlight effective ways to manage and improve your margin level, ensuring greater stability and flexibility in forex trading.

Applying these tips supports sustainable trading practices and protects your account from unexpected margin calls or stop-outs.

Margin call and stop-out percentages vary depending on the broker and regulatory environment:

| Region/Broker | Margin call level | Stop-out level |

| EU (ESMA Regulated) | 100% | 50% |

| UK Brokers | 100% | 50% |

| US Brokers (NFA/CTFC) | Varies (Often 100%) | Varies (20%-30%) |

| Offshore Brokers | Varies widely | Varies widely |

Always review the Product Disclosure Statement (PDS) provided by your broker to fully understand margin requirements and protections. Regulatory compliance ensures safer trading but may affect margin policies.

Read more:

A healthy margin level typically ranges from 200% to 500%, providing a safety buffer above the stop-out threshold. This buffer helps accommodate market volatility and allows flexible trading without triggering margin calls prematurely.

Yes. Closing a losing trade frees up used margin and, if it limits further losses, can increase equity. For example, closing a position incurring a $200 paper loss may raise your margin level from 90% to 110%, restoring trading capacity.

Absolutely. Higher leverage means smaller required margin per trade but magnifies equity swings. This can cause sharper drops in margin level and increase the likelihood of margin calls during volatile markets.

Margin level measures overall account risk as a percentage of equity to used margin. Free margin is the actual amount available to open new trades. Both are critical but serve different decision-making roles.

In summary, understanding what is margin level in forex is the foundation for managing risk and protecting your trading account. By knowing how to calculate it, interpret critical thresholds like the 100% margin rule or stop-out levels, and apply practical strategies, traders can safeguard their equity and trade with greater confidence.

At Webtaichinh, our mission is to make complex financial concepts easy to understand, helping you build a strong knowledge base through the Forex Education category. Keep learning, keep practicing, and you’ll be better prepared to navigate the dynamic world of forex trading.

Web Tai Chinh is a portal that updates news and information related to finance quickly and accurately, helping users have an overview before investing, clearly understanding concepts and terms related to Finance. Explore more insights in our Forex category, start your FX trading journey today with the right partner for long-term success.

📞 Contact: 055 937 9204

✉️ Email: webtaichinhvnvn@gmail.com

📍 Address: 13 Ho Tung Mau, An Binh, Di An, Binh Duong